Our award-winning software can pay employees and file taxes in all 50 states. You’ll be able to process payroll for all your remote workers in the same pay run, and we don’t charge any extra fees for each additional state. It’s the best service and the best value.

Hiring workers just got easier. Send paperwork like offer letters and W-4s electronically for e-signature, and keep it all organized with built-in document audits and storage. We even take care of filing the new hire paperwork in every state where you have workers.

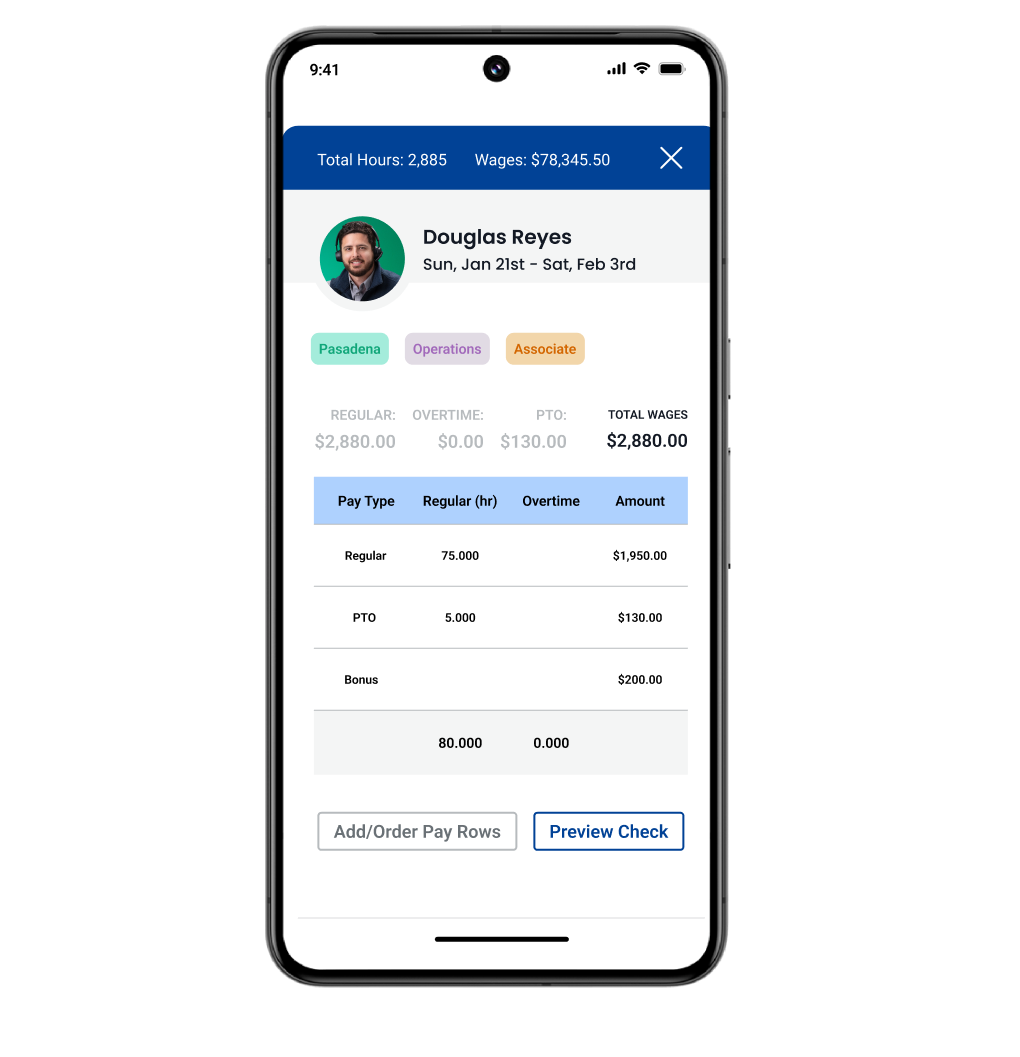

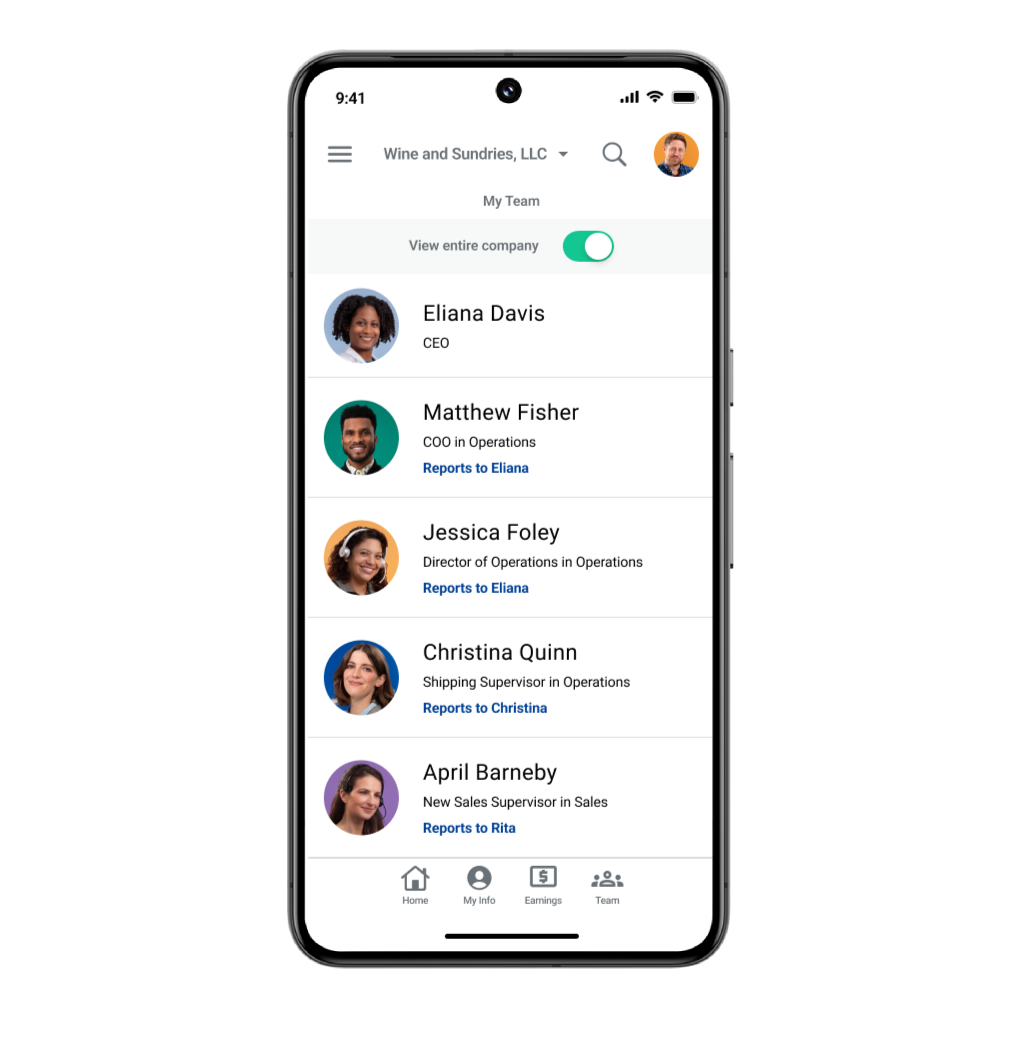

Remote employees can’t just pop into the HR team’s office. Our employee self-service lets your team pull their own pay stubs, request time off, and even update their own address or bank details. It’s all in the app, so remote employees can do things from anywhere.

— Laura, The Cleaning Authority

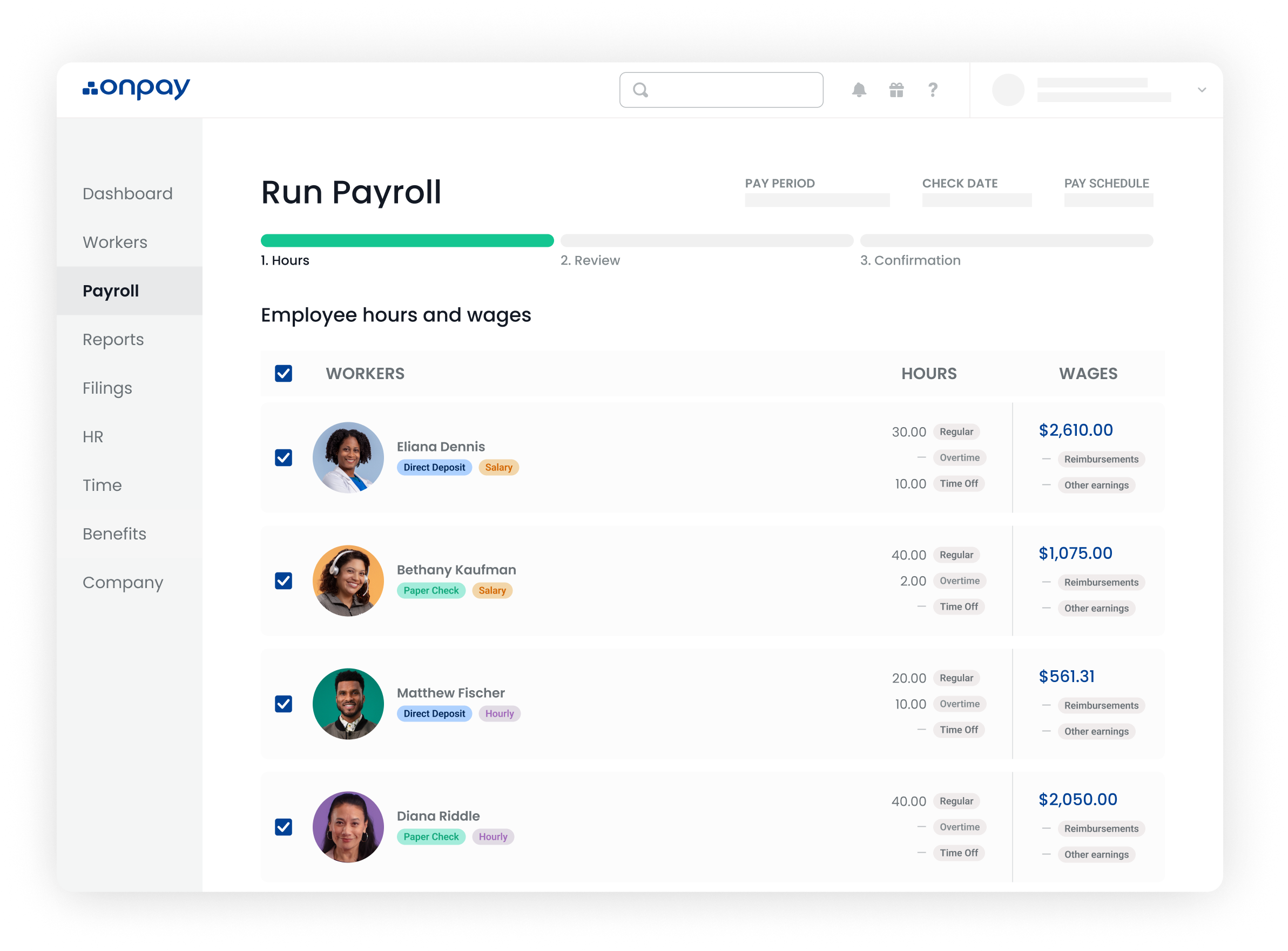

Pay all of your workers in the same pay run, regardless of location — and leave the calculations to us. We’ll automate all of the federal, state, and local taxes for every workers’ location, and with our accuracy guarantee you can relax knowing it’s done right.

OnPay gives you everything you need to get things right for on-site and remote workers at the same time. Pay the whole team in a few clicks, and keep it all organized with built-in HR tools. You’ll save time and keep everyone connected.

Everything you need to pay remote workers starts at just $40 + $6/person each month (and there are no hidden fees, ever).

Our team of pros will set everything up for you, so it’s easy to get started.

If you have employees in different cities and states, you’ll need to deal with different payroll tax filings and payroll tax rates. Each state also has its own requirements for reporting new hires. OnPay takes care of all these to-dos, but if you want a better sense of what goes into paying a remote team, here’s a more detailed overview.

Payroll taxes for each employee are based on where their work is performed. If you have any staff who work from home, that means they should be taxed based on the rates for their location. OnPay’s payroll software makes it easy by automating all of the federal, state, and local tax calculations based on an employee’s worksite address.

If you pay workers in multiple states, you are required to file and pay taxes in each state. OnPay will automate the tax filings and payments everywhere that you pay workers. Also, keep in mind that some cities also require employers and employees to pay payroll taxes. OnPay handles all of these payments for you. See more payroll software details.

With the right software, onboarding a new hire virtually can be a breeze. Our app lets you send new hire paperwork and W-4s for e-signature, and it’s all stored securely in the cloud. You can even create custom onboarding workflows and assign tasks to workers to make sure a new hire has everything they need. See more HR features.

Yes! Our payroll software lets you run things your way. You can pay your entire team in one pay run, or handle things separately for different worksites or types of workers.