OnPay combines more than 30 years of experience with the best technology to give restaurants streamlined, accurate payroll and HR software. We make it easy to handle multiple pay rates for workers who wear a lot of hats in and out of the kitchen. We’ll automate all of the calculations from overtime hours to minimum wage tip makeup and back our work with an accuracy guarantee.

— Shawn S., 1830 Chophouse

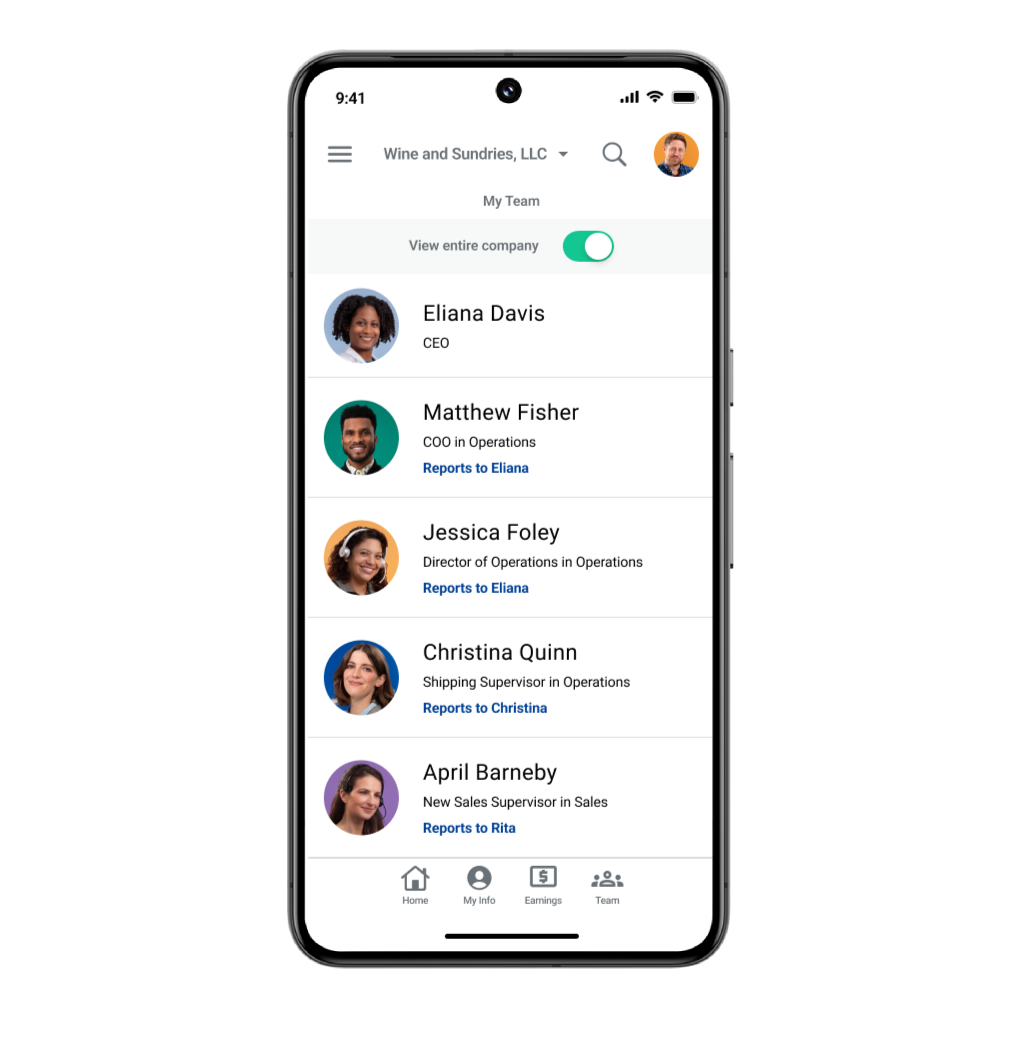

Ask new employees to handle their own paperwork online. You’ll save time on repetitive tasks, reduce mistakes, and let them make changes or pull paystubs themselves.

Employee onboarding, PTO tracking, a secure document vault, and a library of HR templates are just a few clicks away in OnPay. Our user-friendly platform helps you easily manage and automate crucial tasks, freeing up your time to focus on growing your business.

We also help you stay compliant (without racking up extra fees). Protect everyone with a pay-as-you-go workers’ comp plan. We’re also a licensed insurance broker in multiple states, so it’s easy to offer health benefits.

OnPay helps keep your bar’s and restaurant’s payroll expenses under control. Starting at $40 + $6 per person per month, we guarantee transparency without any hidden fees.

Try OnPay out yourself to see how easy payroll and HR can be. To get started, just share a few basic details about your business. Our team of pros will set everything up and import your employees’ information for you.

Yes, it is the responsibility of the employee to report tips to their employer. The Internal Revenue Service states all employees must:

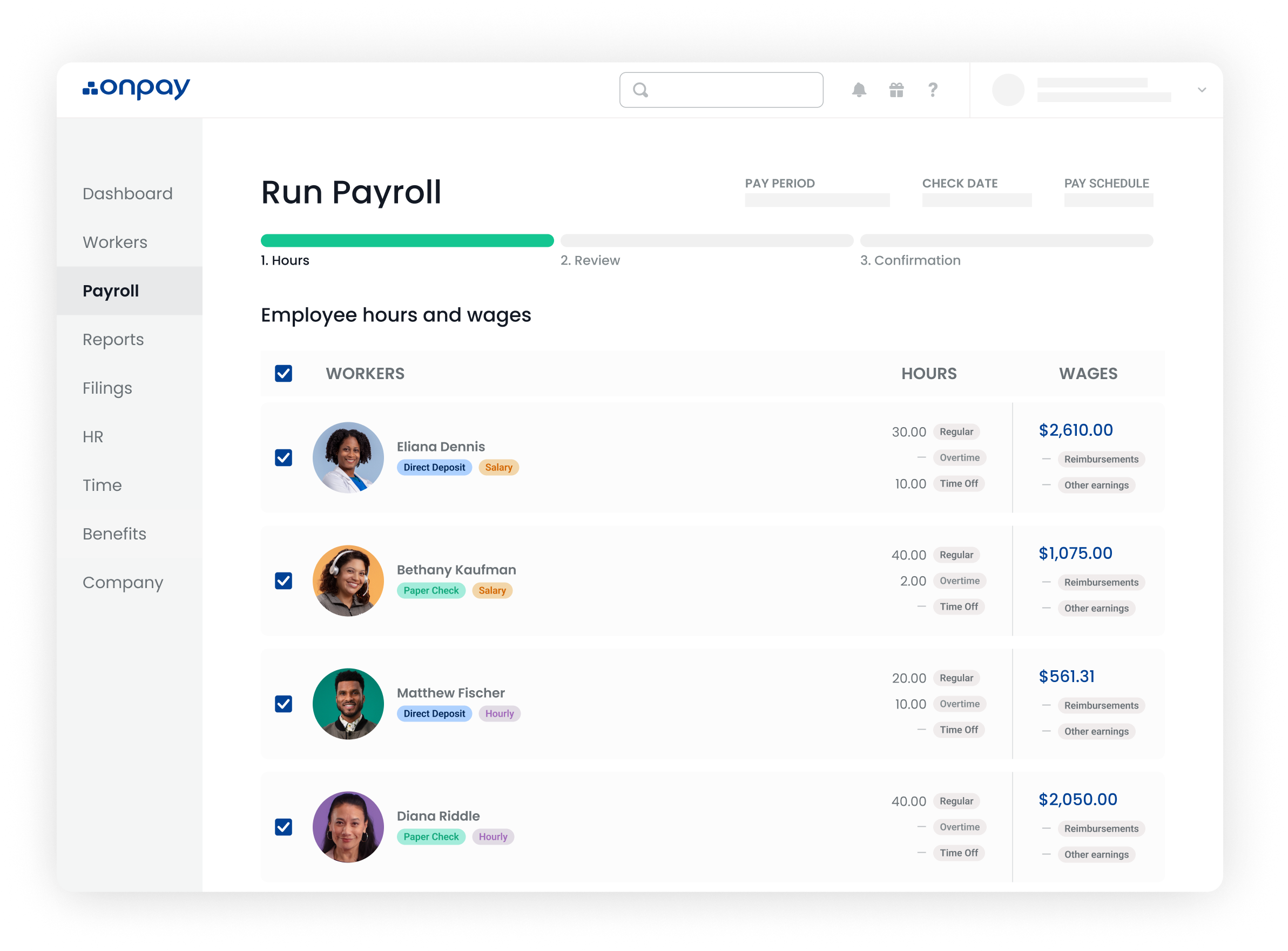

When paying workers in OnPay, we make it easy to handle multiple pay items — including hourly wages, cash tips, controlled tips, and anything else.

When you run payroll in OnPay, you can handle tips as a separate pay item for good record keeping. And our built-in payroll reports make it easy to see the breakdown of everyone’s pay history.

Your restaurant business must pay a payroll tax when you compensate employees, based on the wages you disburse. Taxes are usually calculated as a percentage of the salaries you pay your staff and finance social insurance programs, such as Social Security and Medicare.

Restaurant employers need to withhold taxes – including income taxes and the employee’s share of social security tax and Medicare tax – based upon wages and tip income received by the employee and to deposit this tax. OnPay automates the calculations and withholdings when you process payroll, and we’ll handle all of the required tax filings and payments — so it’s one less thing on your plate.

Most states have minimum wage tip rates and it varies on where you do business. If a worker’s combined wages and tips don’t meet the minimum wage for the hours worked, you will have to add additional earnings known as a tip makeup to their paycheck. OnPay makes it easy to make sure you’re meeting minimum wage requirements with a built-in tip makeup feature that automates all the calculations.

Paying your team doesn’t need to be a hassle — no matter who’s involved. Small businesses are hiring a bigger mix of in-house employees and contract workers these days, so we’ll let you process all the workers you need to pay in the same pay run. We handle W-2 forms and 1099 filings at the end of the year. And if a worker goes a month without being paid through OnPay, you won’t be charged for them.