From finance to HR, OnPay makes it easy to run payroll, offer employee benefits, and minimize the time spent on back office “to-dos.” We automate all tax filings and payments, provide custom reporting, and most likely integrate with your preferred accounting software. And with OnPay’s accuracy guarantee, you can feel confident that the calculations are taken care of so you can focus on growing your business.

— Grand Valley Enterprises, LLC

Our in-house team makes it simple to stay compliant, pick health and retirement plans from top providers, and get your team on board.

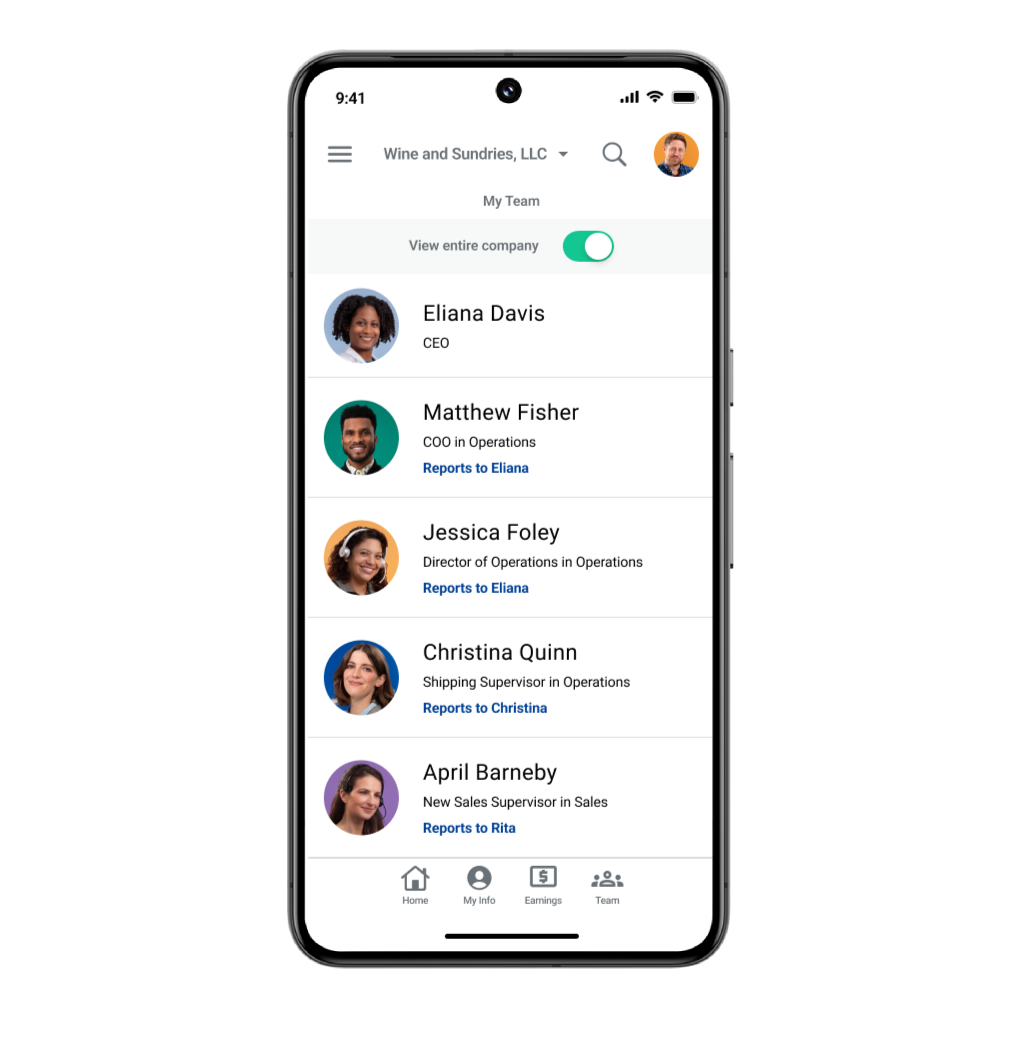

Bring in extra help without losing control. Six levels of permissions let admins delegate payroll and HR duties to teammates or external advisors.

From QuickBooks and Xero to top time-tracking software, our customizable integrations let you sync key financial data in a single click.

We make it easy to know exactly what you’ll pay. With OnPay, you get all the essentials starting at just just $40, plus $6/employee per month.

From effortless payroll to organized HR, we give you the software and services you need to build a successful team — and we’ll set it all up for you.

There’s a very good chance we work seamlessly with the time tracking software you already use and can currently connect to Quickbooks Time, When I Work, and Deputy. Here’s more details on the integrations we offer.

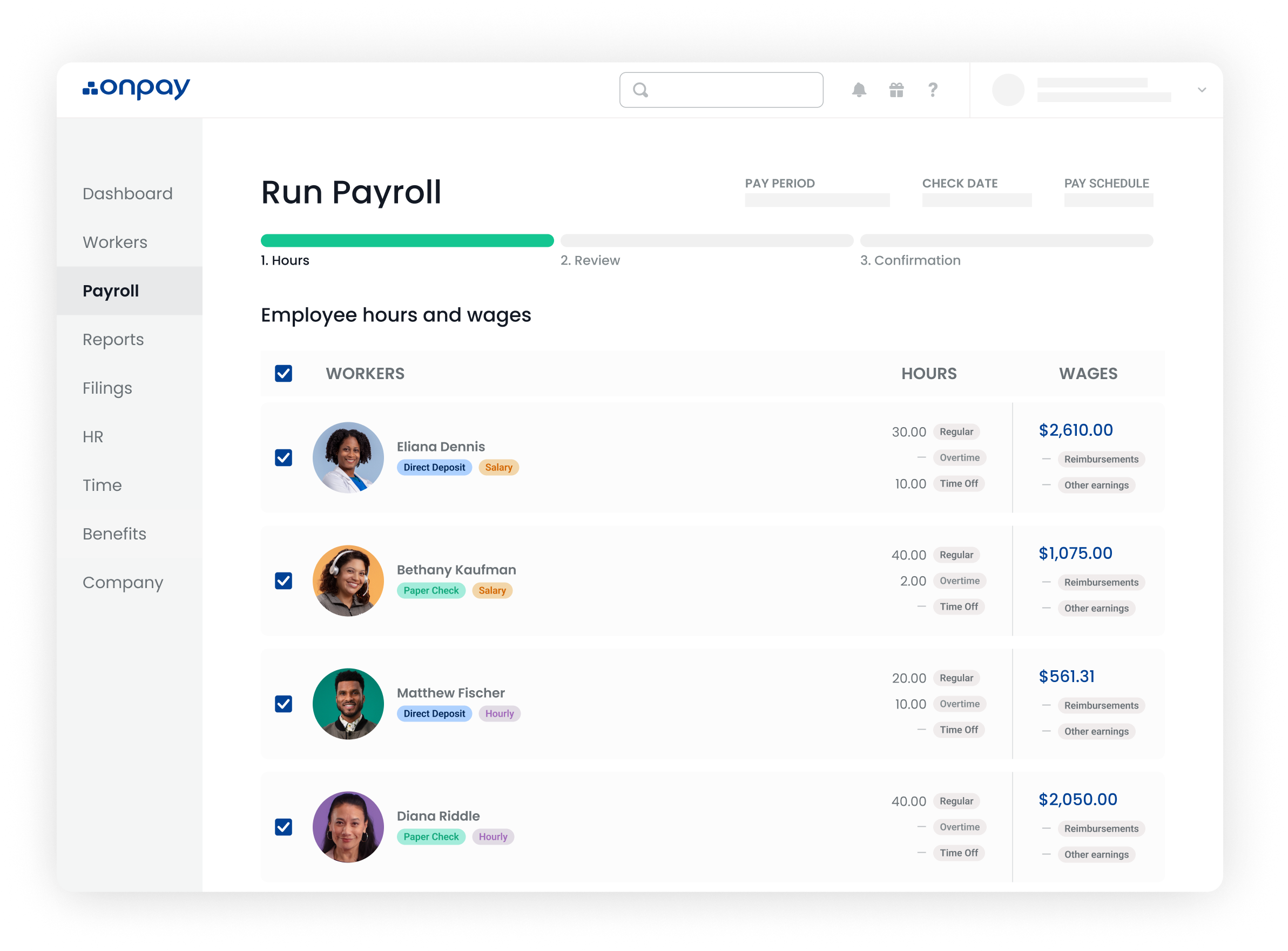

Paying your team should be hassle-free — no matter who’s involved. Because many businesses are hiring a greater mix of in-house and contract workers these days, we’ll let you process all of the employees you need to pay in the same pay run. On top of that, we handle W-2 forms and 1099 filings at the end of the year. And if a worker goes a month without being paid through OnPay, you won’t be charged for them.

Yes! OnPay reports new hires on your behalf in all fifty states, plus the District of Columbia (DC). New hire reporting is typically completed every Friday by the close of business.

Yes! We are able to handle payroll in all 50 states — and at no extra cost. With telework on the rise in recent years, we know that having employees in multiple states is becoming a common practice for many companies. Here is more information on state tax regulations and you can see exactly what you need to register.