Whether you manage an entire franchise brand or are opening your first business location, OnPay gives you everything you need to keep payroll, HR, and benefits running smoothly. You can run multiple business branches from one simple dashboard, and flexible permissions let you hand off more tasks to your team. And with OnPay’s accuracy guarantee, you can relax knowing the calculations and filings are done right.

— Grand Valley Enterprises, LLC

Keep the books balanced and cut down on data entry by syncing accounting and time tracking software with payroll. You’ll get a clearer picture of your franchise’s finances without lifting a finger.

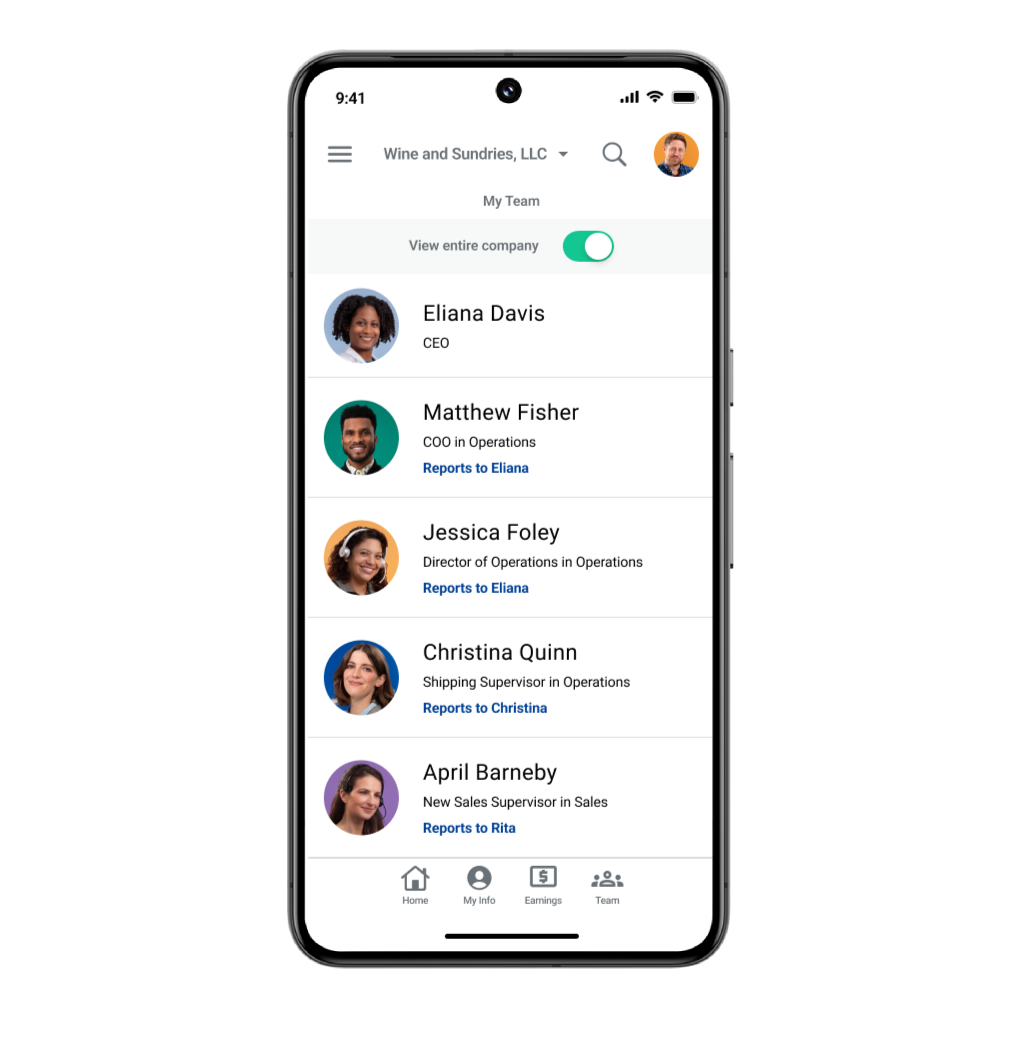

Stay organized and save time with a secure document vault and in-app employee self-onboarding. We also help with PTO accrual and tracking, employee self-service, and task assignment.

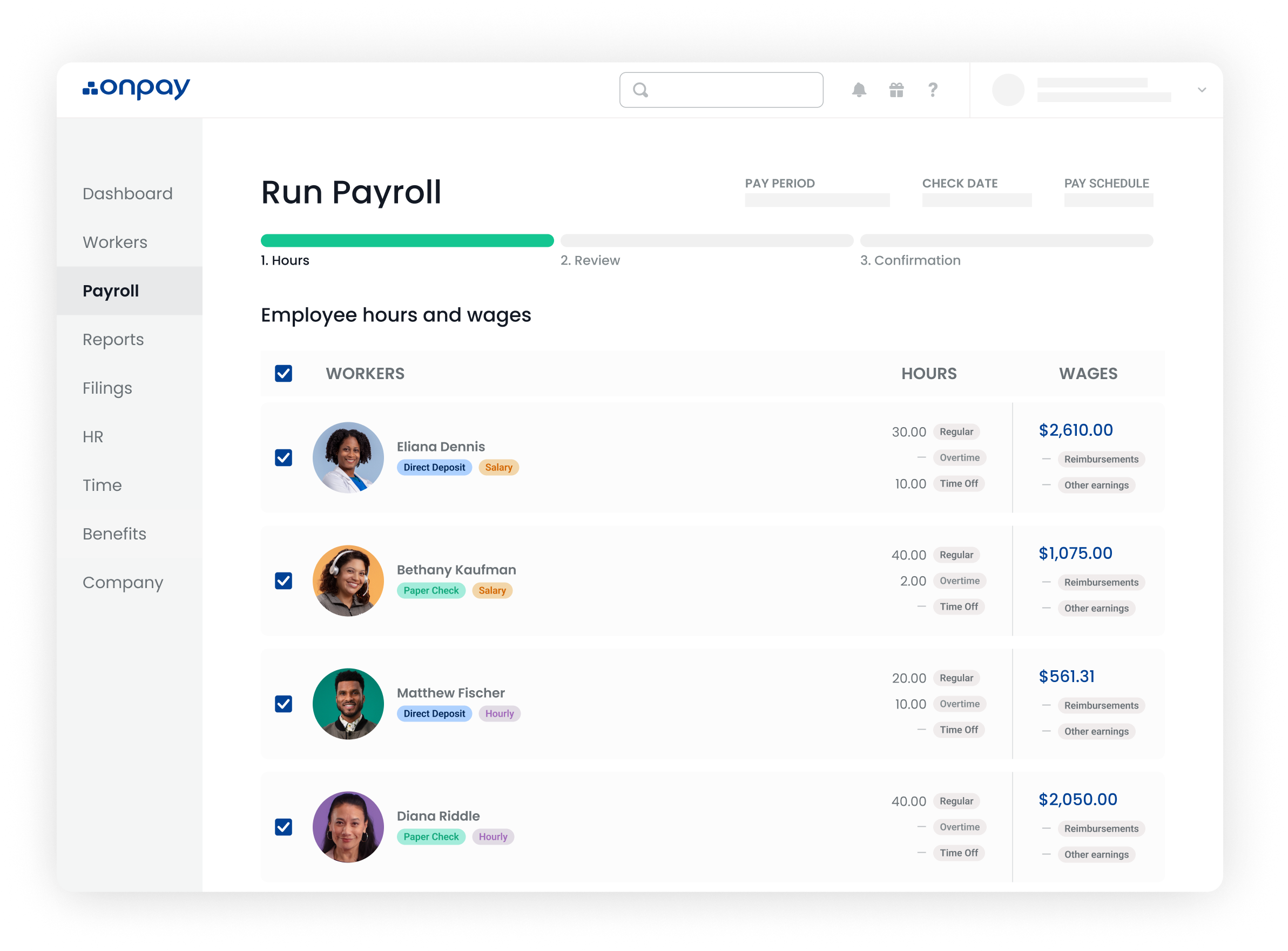

Get the flexibility to run payroll however you want. With six levels of permissions, you can delegate responsibilities to your team leads and choose visibility for each location.

Our pricing starts at just $40 + $6/employee per month. This means that you only pay for the number of active employees, making it a cost-effective solution for growing your franchise.

Try OnPay out yourself to see how easy payroll and HR can be. To get started, just share a few basic details about your business. Our team of pros will set everything up and import your employees’ information for you.

Usually, it is the responsibility of the franchisee or franchise owner to pay employees and to withhold federal, state, and local taxes. There can be instances where a franchisor manages payroll (depending on franchise agreements or arrangements). If you’re unsure of your obligations, reach out to your bookkeeper, accountant, tax professional, or franchisor.

Yes. You must pay yourself through a payroll system if you own an S Corporation, a C Corporation, or an LLC that chooses to be taxed as an S Corporation. OnPay works with LLCs that pay themselves annually or weekly. For any specific questions related to any of the business structures mentioned, catch up with your bookkeeper, accountant, or tax professional.

Despite the name, a franchise tax is not a tax for starting or purchasing a franchise. It’s a tax that some states charge for the right or privilege of doing business in their state. Fees vary state-to-state, and if you are an LLC, partnership, or corporation, you may be subject to a franchise tax. States that currently have a franchise tax in place include: Alabama, Arkansas, Delaware, Georgia, Illinois, Louisiana, Missouri, New York, North Carolina, Oklahoma, Pennsylvania, Tennessee, Tennessee, Texas, and West Virginia. This list is subject to change, so be sure to check your state’s local requirements to be sure you’re meeting your obligations. For additional questions on franchise tax, check in with your accountant, bookkeeper, or trusted tax professional.

Yes, state and federal payroll taxes must be paid on employee compensation by franchises and chains. Payroll taxes are usually calculated as a percentage of the wages a company pays to its employees.