More from our experts

In the simplest terms, payroll processing is how employers calculate and distribute wages to their employees. It involves calculating wages, making sure deductions are accounted for, withholding taxes, and making sure employees receive their paychecks or direct deposits accurately and on time. Though there’s a lot that goes into getting this right, it’s basically a “must-do” even if you are an employer with just one employee. Though there’s lots of administration happening behind the scenes to make this operation work right, it’s a process that employees expect to run smoothly no matter what.

Fast facts about setting up a payroll processing system

- Employers use payroll processing to calculate the wages they owe employees

- Payroll processing also accounts for federal, state, and local tax withholdings and making sure taxes are withheld and remitted to the appropriate agencies

- Doing payroll must account for deductions beyond just taxes, such as health insurance premiums, 401(k) contributions, and wage garnishments

- Employers must keep detailed payroll records for a set number of years in order to comply with IRS payroll reporting and tax regulations

In this employer’s guide, we’ll cover the steps in the payroll process, the information you’ll need to run payroll properly, and the different options employers have when adding this task to their operations.

Primer: How does payroll processing work?

Put simply, payroll processing is an important part of a company’s operations. It allows them to manage employees’ salaries, bonuses, benefit deductions, make sure the appropriate state and federal tax withholdings are taken care of, and determine how employees receive their net or “take-home” pay.

Running payroll is an administrative task that employers must implement so that each employee is compensated correctly based on their employment terms and work hours.

What is payroll processing in HR?

Human resources (HR) often helps ensure that new hires complete necessary paperwork when onboarding, including tax documents like Forms W-4 and I-9, so payroll can be run properly. They also verify personal information such as Social Security numbers, bank details for direct deposits, and workers’ benefit selections. In many cases, they are responsible for managing employee data, including salary information, tax withholdings, and deductions.

— David Kindness, CPA

Why is payroll processing important to an organization?

Payroll processing is not just about cutting checks; it’s also about maintaining trust and legal compliance. Your employees count on timely and accurate payments, and they expect this process to be as smooth as clockwork (and may not understand the intricacies of how much preparation and compliance go into it).

Secondly, Uncle Sam expects his due (in the form of employment tax deposits), and the IRS breaks down how penalties and fees can add up. These penalties can include.

- Failure to deposit penalty: Also known as the failure to pay penalty, this applies to employers who withhold employment taxes but don’t deposit them with the IRS on time. The penalty can be either 2%, 5%, 10%, or 15% of the unpaid taxes, depending on how late your deposit is. The IRS also charges interest on unpaid penalties.

- Failure to file penalty: This penalty applies if an employer doesn’t file payroll tax returns on time, even if they have already paid the taxes. The penalty is usually 5% of the unpaid tax per month or part of a month that the return is late (up to 25%).

- Accuracy penalty: Applies if there are errors on your payroll tax returns, such as incorrect calculations or missing information. The penalty is 20% of any unpaid taxes due.

Having a buttoned-up process in place helps you avoid unwanted attention from the IRS and the peace of mind that you have operations in place to make sure employees get paid what they are owed — and keep from thinking something is amiss when they are looking out for payment.

How hard is payroll processing?

While payroll processing can seem overwhelming due to its many moving parts, breaking it down into manageable steps makes it much easier. Whether you run payroll manually or use software, understanding the basic principles will set you on the right path.

What do employers usually get wrong when processing payroll?

Processing payroll efficiently and effectively depends on how you set up your payroll and how you run it. It’s really just a bunch of small steps that, when added up, get your employees paid and give Uncle Sam his cut.

Let’s look at some of the more common payroll mistakes employers make when processing payroll.

- Misclassifying employees: This happens when an employer lists an employee as an independent contractor or vice versa. This can lead to trouble with the IRS and the Department of Labor (DOL), because taxes and employment laws are different for each classification.

- Not keeping up-to-date with changing laws: Minimum wage laws, overtime regulations, and employment tax laws can change over time. Failing to stay updated on these changes could lead to non-compliance and potential penalties.

- Security issues: Payroll data, including personal information, pay rates, and more, are sensitive and need to be protected. Employers should have strong security measures in place to safeguard employees’ personal and financial information. A good payroll software will solve this problem for you with built-in security measures like end-to-end encryption, secure data storage, user access controls, and more.

Employers can also make mistakes like neglecting to report court-ordered wage garnishments, making manual errors while filing, missing deadlines, and more. Using the information in this article, along with reputable payroll software, will help you avoid these issues and help you keep the processes you put in place running smoothly.

How do business owners pay workers?

Almost 50% of small businesses use payroll software when paying employees

Basic payroll processing pointers

How long does payroll processing take?

The time required for payroll processing varies based on your business size and the complexity of your payroll. On average, it can take several hours to a few days for each pay period, especially if done manually. The variables here can include

- How many people are on your staff

- Classification of workers

- Different types of payments you make (wages, salaries, bonuses, tips, PTO, etc)

- type of pay period you choose

If you process payroll manually (AKA you perform each step of the process), then processing payroll can take a member of your team anywhere from several hours to an entire week to complete. This is because they need to collect information, figure deductions, calculate tax withholdings, create and send paychecks to employees, and send taxes to federal and state tax authorities, all by hand.

If you’re using payroll software, then processing payroll can take a member of your team a couple of hours or even less than an hour to process payroll. This is because payroll software stores your employees’ information and collects, organizes, and calculates payroll and employment tax information each pay period. That means that you just have to double-check that the information is correct and click a button, and the software will do the rest.

It can also save you time, headaches, and money, and make processing payroll much faster than managing the process manually.

We also asked Billie Anne Grigg, a bookkeeping expert with over a decade of experience, what employers should consider.

Bookkeeper’s corner

“In short…payroll used to be difficult, but it’s gotten much easier. That said, payroll is still a critically important responsibility for a business, so don’t confuse processing ease with a lack of seriousness.”

— Billie Anne Grigg, Profit First Professionals

What are your top tips for an effective payroll process?

- Don’t do it manually. If you only have one or two employees, you might be tempted to go the spreadsheets-and-tax-tables route. Seriously, don’t do it. Invest the dollars to manage your payroll with software.

- Don’t try to “fudge” on the rules. If you hire an employee, treat them like an employee, not a freelancer or independent contractor. Withhold the appropriate payroll taxes, match them as required, and submit your payments on time.

- DO make sure you get – and stay – organized. This is another area where payroll management software is helpful. Most platforms will prompt you with email or text reminders that payroll is due soon. But taking a few minutes to plug payroll and tax schedules into your calendar is also a good idea.

- Get help. You don’t have to hire someone to manage payroll for you, though outsourcing this function is a good use of your time and dollars. But even if you decide to manage payroll yourself, engage with a bookkeeper or an accountant or even a payroll specialist to make sure you set things up correctly.

What information do employers need to process payroll?

To process payroll, you’ll need several pieces of information:

- Employee personal details (name, address, social security number) – don’t forget to ask for this info from any new hires you brought on board!

- Employment terms (salary or hourly rate, benefits) or changes in employee status

- Time and attendance records

- Tax filing status and allowances, plus any updates in tax forms

- Deductions and contributions (health insurance, retirement plans, etc)

Below is some specific data you’ll want on the docket to make this process run smoothly.

| Employee information to have ready | ||

| Completed W-4 form New employees typically complete the employee withholding certificate on the first day on the job. It helps you properly withhold the correct federal income tax from employee wages. |

I-9 form This is another must-complete piece of paperwork that new hires need to fill out during day one. It is a requirement from the US Citizenship and Immigration Services and is used to verify the identity and employment authorization of individuals hired for employment in the United States. |

W-9 If you work with freelancers, they’ll need to complete Form W-9. Even though it’s for your records (and you don’t need to send it to the IRS), hold onto it so you can complete a 1099 at the end of the year properly. This is how contractors get the information about what you paid them on projects. |

| Retirement savings permission Many employers offer access to retirement savings plans (and some states even require this). But you’ll need employees to approve this voluntary payroll deduction so withholdings can be made to savings vehicles such as a 401(k), Simple IRA, SEP Plan, or others. |

Authorization for insurance deductions You’ll need your employee’s permission to deduct medical insurance premiums toward health insurance, and their authorization needs to be in writing. |

Banking information for direct deposit If you’re offering direct deposit to pay employees, you’ll need bank information so you can route wages directly to bank accounts for the members of your team. |

Now that we better understand what data you’ll need to get the process off on the right foot, let’s cover specific steps that can help you get this right from the start.

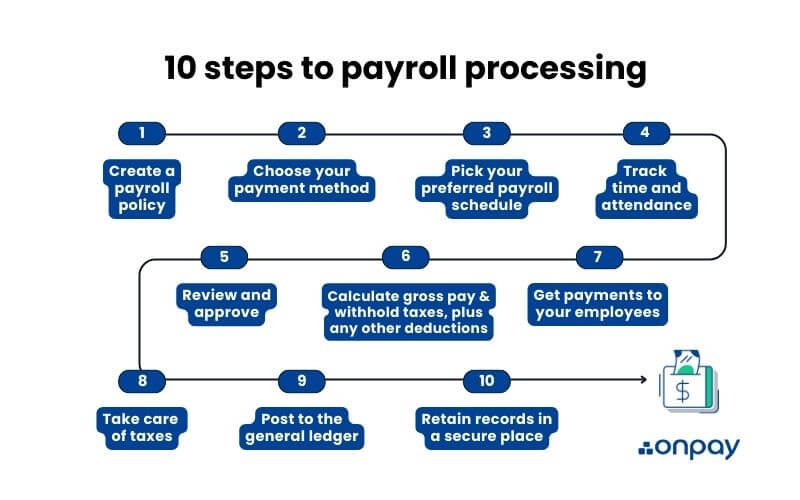

What are 10 to steps make payroll processing work?

Below we break down all the steps that come with this to-do in detail and here’s a visual with a bird’s-eye view of what most employers do.

Put your best foot forward with a payroll policy

You likely have policies in place for company attendance, behavior in the office space, or dress code. In addition, it can be a good idea to outline your company’s payroll policy, stick to it, and make sure employees have access to it. A payroll policy simply documents how items such as timesheets are maintained (and why), what the company wage methods are, how deductions work, what staff members should do if they experience errors on a paycheck, and the type of payroll schedule a company uses. It keeps everyone on staff informed and on the same page.

Choose your payment method

Decide how you will pay your employees, whether that’s via direct deposit, paper checks, cash, or payroll cards. Let’s take a quick look at each of these options, as well as the pros and cons of each:

- Direct deposit: Direct deposit provides a fast, secure, popular, and convenient method for paying employees by electronically depositing funds directly into employees’ bank accounts on payday. There are virtually no downsides to utilizing direct deposit — the only issue is if an employee doesn’t have a bank account for some reason. Learn how to set up direct deposit for employees.

- Paper checks: Paper checks are a traditional, software-free method of paying employees where you simply write a check to each employee, put it in an envelope, and mail it to their home address or P.O. box. This payment method is simple, but it can be time-consuming because each check has to be sent manually. Additionally, there is a risk that the checks could be lost or stolen in transit.

- Cash: The simplest form of payment is cash put in an envelope. This method is simple and allows employees to have immediate access to their income, but the downsides are similar to paper checks: counting out bills is time-consuming, and there’s a chance the cash could be lost or stolen.

- Payroll cards: Finally, employers can pay employees via payroll cards, which are basically prepaid Visa cards with their pay loaded onto them. Employees can use these cards to make purchases or transfer the funds to a bank account. These cards carry a similar risk to paper checks and cash in that they can be easily lost or stolen, and the funds are often unrecoverable if this happens.

Pick your preferred payroll schedule

Establish a pay schedule that suits your business and complies with state laws. Common pay schedules are weekly, bi-weekly, semi-monthly, and monthly. Notify your employees of your chosen schedule so they can manage expectations and plan their income appropriately, then stick to it for the long term. If you decide you need to change payroll schedules, no sweat–just keep employee expectations in mind and notify them way ahead of time of any changes to their pay dates.

When and where do business owners process payroll?

In a recent OnPay survey of small business owners, here were some interesting data that was shared about when and where payroll is run:

- 38% are early risers that run payroll in the morning

- 33% handle this to-do at home

- 31% process payroll in the evening

- 21% take care of this important task at the office

Timing (and attendance) is everything

In many cases, you’ll want a way to track hours worked, including any overtime, to calculate pay correctly. In most cases, time tracking software is used to do this (OnPay has a number of integrations to choose from). The reason this is important is if you have workers with weekend hours and overtime, you want to be sure that any time and a half pay is handled properly. Also, if you happen to offer shift differentials to employees who take on less desirable shifts, this may be something else to consider.

Review and approve

Review timesheets and attendance records for accuracy and approve them before processing payroll. Depending on your company’s structure, this can be the responsibility of a supervisor or payroll specialist. We cover keeping wage records on file toward the end of these steps, but the point is, in case of an audit, it can be a good idea to have whoever signs off on approving time on file in case these numbers need to be reviewed in the future.

Calculate gross pay, and withhold taxes, and apply any other deductions or benefits contributions.

Taxes are generally paid to federal and state governments (except for AK, FL, NV, NH, SD, TN, TX, WA, and WY, which do not have income tax), and sometimes to local governments (like counties or cities) as well.

Let’s look at a quick example of how to calculate wages and deductions. Let’s assume that the employee makes $100,000 per year and is paid once per month. They live in Pennsylvania and contribute 5% to an employer-sponsored retirement account, and pay $300 per month for health insurance.

- The employee’s monthly gross pay is $8,333.33 per month ($100,000 / 12)

- Their payroll deductions include $416.67 for their 401(k) retirement account ($8,333.33 × 5%), which is deducted before calculating taxes.

- Their taxable pay is $7,916.67 ($8,333.33 – $416.67) per month.

- Because they live in Pennsylvania, both federal and state taxes need to be withheld:

- Federal taxes: their effective federal tax rate is 16.79% for 2024, so their federal income tax withholding is $1,329.42 ($7,916.67 × 16.79%) per month.

- They also owe FICA taxes, which are taxed at 7.65%, so their FICA tax withholding is $605.63 ($7.916.67 × 7.65%) per month.

- Next, they owe FUTA tax, which is taxed at 0.6%, so their FUTA tax withholding is $47.50 ($7,916.67 × 0.6%) per month.

- Pennsylvania charges an income tax rate of 3.07%, so their state tax withholding is $243.04 ($7,916.67 × 3.07%) per month.

- This means that their total tax withholdings are $2,225.58 per month.

- Next, we’ll need to deduct $300 for their monthly health insurance payment.

- Finally, after accounting for taxes and deductions, their take-home pay is $5,391.08 ($8,333.33 – $416.67 – $1,329.42 – $605.63 – $47.50 – $243.04 – $300) per month.

To learn more about how to calculate payroll taxes, check out our step-by-step guide.

Get payments to your employees

Most employees keep payday at the front of their minds, so you’ll want to have this part of the process squared away. Some of the most common ways employers pay employees is through:

- Direct deposit

- Issuing paper checks

- Cash payments

- Load payroll cards

Be sure to review the ‘Choose your payment method’ section above if you’re curious about the pros and cons of each of these payment options.

Take care of taxes

Make sure you are filing and paying any payroll taxes you are responsible for, both in your state and on a federal level to avoid unwanted attention from Uncle Sam (usually in the form of penalties). We’re referring to obligations such as Social Security, Medicare, and unemployment taxes. And don’t forget to pay federal and state income taxes!

Post to the general ledger

Record payroll expenses in your accounting system to keep your financial records accurate and up-to-date.

Retain records in a secure place

Keep detailed payroll records for each pay period, ensuring they are stored securely but are accessible for audits or employee inquiries. This is more than just housekeeping–there are some federal laws that make this a necessary step. The Department of Labor, in conjunction with the Fair Labor Standards Act (or FLSA), makes maintaining these records an employer responsibility for at least three years. Learn more in our guide to payroll record retention.

Did you know?

Nearly 40% looked of businesses look for payroll software with features to help them administer benefits and streamline their HR operations.

Source: OnPay: 2024 Small Business Market Survey

Options to process payroll businesses might consider

Manual payroll processing

If you have a small team and straightforward payroll, handling it yourself can be cost-effective. However, it requires a good understanding of tax laws and meticulous attention to detail. Some companies will have an administrator on staff who can manage this all with spreadsheets while choosing some type of payroll solution they can install on their computer or use in the cloud.

Tips to get payroll processing right

Processing payroll might seem complicated and overwhelming, but once you understand the basics, the process isn’t too bad. Here are a few tips to keep in mind to make sure you get it right time after time:

- Maintain organized records: Keep clear and detailed records of employee wages, deductions, tax withholdings, and pay stubs. This simplifies tax filing, audits, and employee inquiries, and luckily, payroll software can manage this task for you.

- Stay updated on regulations: Federal and state payroll and tax laws can change periodically. Stay up-to-date to ensure compliance and avoid penalties. Consider consulting a tax professional or subscribing to updates from a payroll provider.

- Plan for unexpected events: Be prepared for situations like employee leaves, wage garnishments, or bonuses. Having a clear process for handling these situations will help maintain accurate and timely payroll processing.

Use a payroll service or software

Automated payroll services and software (like OnPay) can simplify the payroll process, reduce errors, and ensure compliance because manual calculations are kept to a minimum (if at all). This type of software can automatically handle calculations, tax filings, and even direct deposits once employee information is set up. Many providers will onboard businesses to make sure all employee information is inputted correctly.

Work with a bookkeeper, CPA, or accounting professional

For added peace of mind, consider outsourcing payroll and tax prep to a professional. They can manage the entire process, provide expert advice, and free up your time to focus on growing your business.

If you are curious how different companies stack up, we have a resource you may find useful because it makes it simple to compare payroll services.

Getting payroll processing right

Getting payroll processing right is essential for your business’s success and employee satisfaction. By understanding the steps involved and exploring your options, you can streamline the process and focus more on what you love — running your business and growing your team. Remember, resources like payroll software (whether OnPay or another provider) and professionals are there to help or point you in the right direction.

If you have any questions or need further guidance, feel free to reach out. We’re here to support you on your journey to hassle-free payroll processing.

Take a tour to see how easy payroll can be.