More from our experts

It can require a lot of time, energy, and organizational skill to get through the IRS checklist of to-dos for starting a new business. You’ll have a fair share of paperwork and forms to keep on file, and a CP-575 letter is probably one of the most important pieces of paperwork you’ll encounter in your inbox (or mailbox).

Fast Facts

- A CP-575 letter includes your nine-digit EIN, official business name, filing address, tax forms your business must file, and due dates for each.

- To obtain an EIN, fill out Form SS-4, Application for Employer Identification Number (EIN), online or complete a hard copy and mail or fax it to the IRS.

- To open business bank accounts, credit cards, or other lines of credit, new business owners may need a CP-575 letter.

- If you misplace your CP-575 letter, you can request an EIN Verification Letter (147-C) as a replacement.

Issued by the Internal Revenue Service (IRS), this form is used to notify you that you’ve been assigned a unique Employer Identification Number — or EIN. Also known as a Federal Employer Identification Number (FEIN), an EIN identifies a business entity — officially putting you on the path to opening your doors.

When you do receive that CP-575 form letter, it means you’re one step closer to joining the ranks of over thirty million businesses (and there’s no shame in doing a little fist bump).

Let’s find out why the CP-575 form letter is so important and how it can help your business.

Keep in mind

We should point out that while sole proprietors can use their Social Security number for business identification purposes, businesses with employees or those that expect to hire employees should apply for an EIN.

CP-575 form letter: What is it and do I need one?

A CP-575 form letter serves as a business verification of sorts. For starters, the letter includes your nine-digit, newly assigned EIN number (some even think of it as a company’s social security number). An EIN is important for businesses that have employees or anticipate having employees. It is not necessary, however, for sole proprietors, who can simply use their Social Security number for business identification purposes.

Additional information you’ll see on a CP-575 includes your official business name, official filing address, a list of the tax forms your business is required to file, and (even more importantly) the due date(s) for filing those forms – which, of course, you won’t want to miss.

Pro tip: The difference between an FEIN and an EIN

The purpose of an FEIN is to identify your business when you’re completing mandatory quarterly and annual federal tax filings (forms such as 941, 943, 940). To be a business in compliance with federal tax regulations, you must have an FEIN.

And not to confuse you, but in addition to the FEIN, there’s also an EIN or Employer Identification Number issued at the state level. State-provided EINs serve essentially the same purpose as FEINs but are used on state tax forms.

States will reference your FEIN when issuing state tax IDs. And most states will not let businesses file taxes at the state level without having a corresponding state tax ID.

— Elizabeth Lamberts, FPC, OnPay Product Consultant

For new business owners, the CP-575 letter is more or less a must-have because you’ll likely need it to set up business bank accounts, credit cards, or other lines of credit. And as you reach the point of setting up payroll, you’ll also likely need to provide a copy of the letter when working with a payroll services company.

Related reading

How do I know if I need to apply for an EIN?

To help you determine whether you need to apply for an EIN, the IRS has a brief test. But don’t worry — it’s fairly straightforward. The questions include:

- Do you have employees?

- Do you operate your business as a corporation or a partnership?

- Do you file any of these tax returns: Employment, Excise, or Alcohol, Tobacco and Firearms?

- Do you withhold taxes on income, other than wages, paid to a non-resident alien?

- Do you have a Keogh plan?

Answer “yes” to any of the questions in Uncle Sam’s quick quiz, and you’ll need to apply for an EIN.

How do I get my IRS notice CP-575?

The IRS will send your business a CP-575 letter to confirm that your business has been granted an employer identification number (EIN), which is basically like a social security number (SSN) but for your business. EINs are nine digits long, and they allow businesses to easily identify themselves when paying taxes, providing tax forms to employees and contractors, and contacting the IRS. The IRS will send you this letter after you apply for an EIN or if you request verification of your EIN, business address, or other business information

The CP-575 letter is an important document for many small business owners because it confirms your EIN, as well as additional information such as your business name, business address, and the federal tax forms that your business is required to file. The letter may also include other specific information unique to your business.

When do I receive my CP-575 form letter?

OK, once you’ve established that you need to apply for an EIN, the next thing to do is complete Form SS-4. While most people take care of this form online, you can also complete a hardcopy of the form and mail or fax it to the IRS.

When your application is approved, you’ll receive the EIN confirmation letter CP-575. The timing of when you receive the letter depends on how you handle submitting form SS-4.

If you complete the application online, the IRS automatically sends you the EIN Confirmation Letter (CP-575) digitally, which you can download at your convenience.

If, on the other hand, you apply by mail or fax, you’ll receive the CP-575 confirmation letter by mail, which can take a while — it usually arrives within four to six weeks of your EIN application.

It’s important to keep in mind that you’ll only receive your CP-575 form letter one time: when your EIN number is initially assigned. You won’t receive a new one annually, so it’s important to keep the confirmation letter in a safe place.

Keep growing

As your business starts to grow, use our free payroll tax calculator any time of day — from your mobile device or desktop.

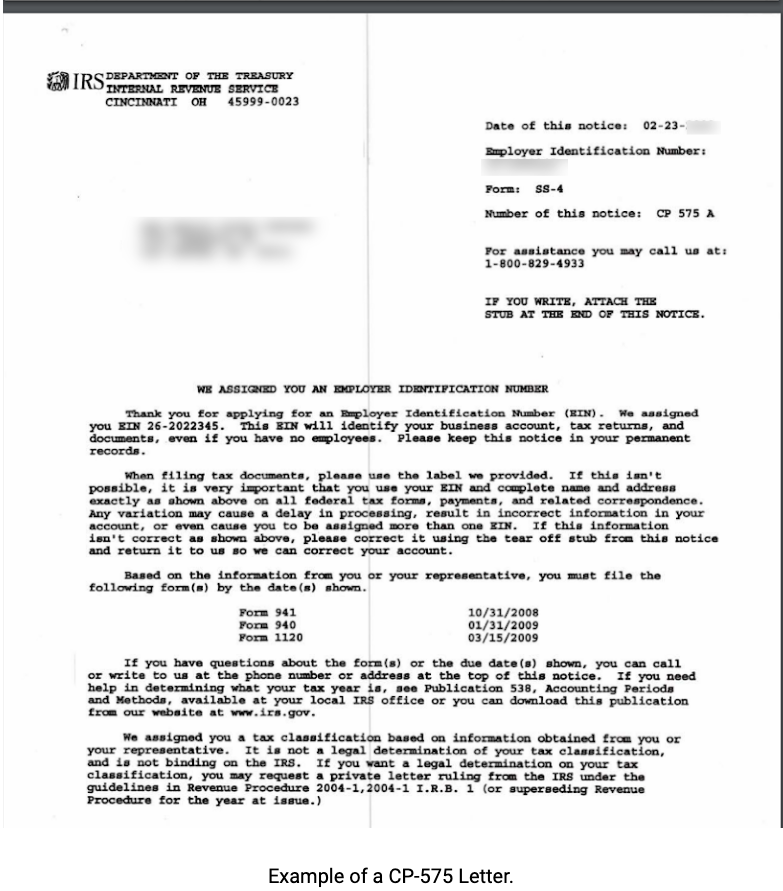

What does an IRS CP-575 form letter look like?

As already mentioned, your IRS CP-575 form letter will include information such as your EIN number, business name, and address. Here’s what it looks like:

What happens if I lose my original CP-575 letter?

Should you lose track of your letter, there’s no reason to panic. Even though the IRS will not replace the original CP-575 letter you received, if you need a copy, you can request the EIN Verification Letter (147-C).

To obtain a 147-C, you’ll need to contact the IRS at 1-800-829-4933 between 7:00 AM to 7:00 PM, Monday through Friday, in your local time zone. There are a couple of exceptions: if you’re located in Alaska & Hawaii, follow Pacific time when calling. It’s important to point out that you can’t request the letter online or via email. The IRS will only send a 147-C letter via mail or fax. You can find more information about this process on the IRS website.

Once received, you can use 147-C as a valid replacement for CP-575. And in the meantime, while you’re waiting for the 147-C, the IRS suggests taking a few other steps if you need to track down your EIN for use completing other documents, including:

- Finding the computer-generated notice of your EIN that was issued by the IRS when you originally applied for the number. (Check your email history!)

- If you used your EIN to open a bank account, or to apply for any type of state or local license, you might also consider contacting the bank or agency to recover your EIN information.

Finally, you can check previous tax returns for your business (if you have filed a return). Your federal tax filing should include your FEIN.

Is a CP-575 the same as 147c letter?

While the CP-575 letter and the 147c letter are very similar, they do serve slightly different purposes. The CP-575 letter is officially called the “EIN Confirmation Letter”, while the 147C letter is officially called the “EIN Verification Letter”.

The CP-575 is a letter that the IRS sends you after you initially apply for an EIN for your business, and it confirms what your EIN is, as well as information such as your business name, business address, and more. The 147c, on the other hand, is a letter that the IRS sends you when your business already has an EIN and you want to verify what it is.

— David Kindness, CPA

Is an EIN the same as a tax ID?

The terms EIN and tax ID are often used interchangeably, but there is a simple difference between the two. The term “Tax ID” includes several types of tax-related identification numbers. An EIN is just one type of tax ID, and others include SSNs (social security numbers), ITINs (Individual Taxpayer Identification Numbers), and more. Each of these types of tax IDs are used to identify different types of taxpayers, like businesses, individuals, and taxpayers who can’t receive an SSN. EINs are used specifically to identify businesses such as corporations, s-corporations, partnerships, and LLCs.

Safeguard your CP-575

We’re by no means trying to cause anxiety, but with identity theft on the rise, it can be a good idea to safeguard your CP-575 letter since it contains important information regarding your business. Even though the risk of someone getting their hands on your CP-575 is probably low, it’s not a bad idea to keep it under lock and key. And while we’re on the subject of organizing files, you may also find our article on how long to keep payroll records useful as you begin to hire employees.

Top-Notch Support

“OnPay is one of the best payroll softwares out there. As a busy CEO who runs his own company, OnPay makes it incredibly simple, fast and their support is also out of this world.”

— Austin, ABTrades, LLC

Congratulations on getting your business off the ground. If you’re looking to dive a bit deeper, use our guide to processing payroll for more insights and information on paying your team for the first time.

This article is for informational purposes only and should not be relied on for tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors for formal consultation.

Take a tour to see how easy payroll can be.