More from our experts

If you’re a small business owner trying to figure out how to calculate payroll taxes, you’re not alone. Over six million small businesses in the U.S. are in the same boat as you. They all have fires to put out, employees to pay, futures to plan, and little to no time to grapple with the IRS tax code.

The good news is that although the tax code may seem complicated, once you figure out what tax filings are required and learn how to do the math, the process is fairly straightforward. With that being said, calculating payroll taxes correctly is critical not only to your employees but also to your accountant and Uncle Sam. That’s why we decided to write this in-depth guide on how to calculate payroll taxes, step by step.

Fast facts on how to figure payroll taxes

- There are four main payroll taxes: Social Security, Medicare, federal unemployment, and state unemployment taxes

- FICA stands for the “Federal Insurance Contributions Act” and it includes both Social Security and Medicare. FICA is paid 50% by employers and 50% by employees

- FUTA stands for “Federal Unemployment Tax Act”, and SUTA is the state version of it. These taxes fund both federal and state unemployment programs

- FUTA and SUTA are both paid 100% by the employer

You should be able to find all the answers to your payroll questions here, but if you hit a wall or simply want to take payroll taxes off of your to-do list, we also offer a simple payroll service that does the heavy lifting for you. And we publish OnPay customer reviews if you want to hear what businesses have to say about working with us.

What is payroll tax?

First things first, understanding what payroll taxes are can be almost as important as knowing how to calculate them. If you don’t understand it, you can’t calculate it! Payroll taxes are the employment-related taxes that employers are required to pay to federal and state governments whenever they pay employees. These taxes include FICA, FUTA, and SUTA, which each have their own tax rates.

Payroll taxes are used by governments to fund various federal and state social programs, such as Social Security and Medicare for retired individuals, and unemployment programs to support workers who have lost their jobs. The different types of payroll taxes are…

- Social Security tax (FICA part 1) – this tax funds the federal Social Security program, which makes payments to retired individuals to help support their lifestyles.

- Medicare tax (FICA part 2) – this tax funds the federal Medicare program, which offers low- or no-cost healthcare to retired individuals.

- Federal unemployment tax (FUTA) – this tax funds the federal unemployment program, which makes payments to individuals who have lost their jobs.

- State unemployment tax (SUTA) – this tax is similar to FUTA, but it’s administered by states to help support unemployed individuals.

FICA taxes are paid 50% by employers and 50% by employees, which means that employers generally withhold the employee portion from the employee’s paycheck and pay it to the IRS on their behalf. FUTA and SUTA taxes are paid 100% by employers. But don’t worry, we’ll explain all this in easy-to-understand terms below.

Before you run payroll

Before you can begin calculating payroll taxes, each of your employees will need to complete a few new employee documents, which include:

- Form W-4: Employee’s Withholding Certificate

- State W-4 (as applicable, depending on your employee’s state of residence)

- Direct Deposit Authorization Form

- Form I-9: Employment Eligibility Verification

Form W-4: Employee’s Withholding Certificate

Each new employee must complete IRS Form W-4, which tells you key information about how much federal income tax (FIT) you’ll need to withhold from their wages. The employee will enter their name, address, and social security number, and answer a few withholding-related questions.

Looking for more information on payroll software and calculating payroll on your own? For an in-depth overview (and information you can reference in the future), read our guide on how to do payroll next.

What is FIT tax?

“FIT” stands for Federal Income Tax, and this is the tax that the federal government charges US citizens on all income they earn from working their jobs. It’s calculated as a percentage of income, and FIT is called a progressive tax, which means the tax rate increases as you earn more income.

— David Kindness, CPA

Who pays FIT?

Federal income taxes are paid to the IRS, and they are required to be paid by basically everyone who earns income in the United States (unless you earn less than the standard deduction amount of $13,850 in 2023 or $14,600 in 2024). FIT is usually withheld from employees’ paychecks by their employers, but if not, then taxpayers are required to pay FIT every quarter. Employers can use each employee’s Form W-4 to determine their withholding amount.

Form W-4 was revised in 2020 and the new form has a five-step process and a new Publication 15-T (Federal Income Tax Withholding Methods) for determining employee withholdings. It no longer uses withholding allowances.

For employees hired in 2019 or prior, you can continue to use the information they provided on the old form W-4. It includes a worksheet that allows your employees to calculate withholding allowances for dependents and children. Some employees may want to fill out a new W-4 if they work a second job, get married, have a child, or get divorced, but you cannot require existing employees to complete a new one.

Employees can also elect to have additional tax withheld or request to be exempt from federal income tax withholding. The new form W-4 provides detailed instructions on how to do this.

Make sure the employee signs the W-4, but don’t send it to the IRS unless requested. Retain it in your employee’s personnel file for a minimum of 4 years after the date of the employee’s latest tax return.

State W-4 (as applicable)

Some states have their own withholding forms. For states that don’t, the Form W-4 will often be used as the basis for calculating state and/or local income tax withholding. A complete list of applicable state tax forms can be found at the Federation of Tax Administrators website.

Direct Deposit Authorization Form

As an employer, you can pay your employees several different ways: paper check, direct deposit, prepaid debit card, or cash. Direct deposit is often the easiest and most secure way to deliver paychecks, which is why it is by far the most popular. In fact, more than 90% of US workers are now being paid by direct deposit.

An employee who chooses to be paid by direct deposit must fill out a direct deposit authorization form, complete with bank routing numbers and account numbers. The form acts as a permission slip for you to deposit the employee’s net pay electronically into their bank account.

As part of the verification process, many employers will ask for a voided blank check to confirm the accuracy of the bank account information provided by the employee. If the employee’s bank information changes, they can fill out a new direct deposit form and give the employer a new voided check with the new bank information. Learn more about setting direct deposit for your employees.

Form I-9: Employment Eligibility Verification

New employees need to fill out a Form I-9 to certify that they are legally permitted to work in the United States (i.e. as a citizen, permanent resident, work visa holder, etc.). They can prove their work status by either providing you their US passport or both their driver’s license and Social Security card.

You are required by law to obtain a signed Form I-9 from your employee before employment commences. You’ll need to complete Section 2 of the form within three business days of the employee’s first day of employment. You should retain the completed form and any supporting documents in your employee’s personnel file.

Best practice

You might also want to have new employees acknowledge their receipt of the company handbook, code of conduct, and any other formal policies at this time. While the acknowledgment isn’t necessary for payroll calculations, it’s a best practice to have your new employees complete all required company forms at the same time. HR software can make it easy to manage all these tasks.

According to the IRS, if an employee fails to furnish a Form W-4, or provides the employer with an invalid W-4, the employer must withhold taxes as if the employee is single or married filing separately with no deductions.

How to calculate payroll taxes: Key figures to think about

In a nutshell, payroll taxes are simply calculated by taking an employee’s gross pay and multiplying it by each tax rate (i.e. Social Security, Medicare, FUTA, and SUTA). We’ll go into the details below, as well as a step-by-step process for how to calculate them, but here is the gist:

- Social Security tax formula: Employee Income × 6.2% = Social Security Tax

- Medicare tax formula: Employee Income × 1.45% = Medicare Tax

- FUTA tax formula: Employee Income × (FUTA Tax Rate – State Credit Reduction) = FUTA Tax

- SUTA tax formula: Employee Income × State SUTA Tax Rate = SUTA Tax

Once you’ve calculated each of the taxes, all you have to do is pay the employer portion (50% of FICA and 100% of FUTA and SUTA), and withhold the employee portion from the employee’s paychecks (50% of FICA) and pay it, and you’re done! Read on below to learn more and see the full calculations broken down. And don’t worry, it’s easier than it might seem.

What is the formula for calculating payroll?

There are a few different ways to calculate payroll depending on the employee, how they’re paid, if they receive benefits, if they pay expenses on behalf of the employer, and whether they’re reimbursed for those expenses. But a simple payroll tax formula that’s easy to follow looks like this: Gross Pay – Gross Deductions = Net Pay. Let’s dive a little deeper on this formula below:

What is gross pay? Gross pay includes the following payments to employees:

- Base salary or hourly wages

- Performance bonuses

- Cost of living stipends for housing, food, travel, etc.

- Gifts given to the employee by the employer

- Allowances for non-work-related expenses

What are gross deductions? Gross deductions include the following deductions from the employee’s pay:

- Payroll taxes: FICA, FUTA and SUTA

- Insurance: employee’s state insurance and health insurance

- Income tax withholdings

- Adjustments related to paid or unpaid leave

- One-time deductions for expenses, loans, etc.

Now that you know what is included in gross pay and gross deductions, you can easily calculate your employee’s net pay. Simply add up all the relevant gross pay items and then subtract all the relevant gross deduction items.

In the next section, we’ll dive a little deeper into payroll tax by breaking down the five steps to calculating employee payroll taxes.

Keep in mind

There are tools that can do all the calculations for you, and when looking for a platform, there’s a lot to keep in mind. That’s why we put together a resource on how to choose payroll software that touches on the features to look for and must-have functionality to ask about.

How to calculate payroll taxes in 5 steps

Once your employees are set up (and your business is set up, too), you’re ready to figure out the wages the employee has earned and the amount of taxes that need to be withheld. And, if necessary, making deductions for things like health insurance, retirement benefits, or garnishments, as well as adding back expense reimbursements.

In technical terms, this is called going from gross pay to net pay.

If you’re trying to figure out a specific step, feel free to skip to the one you’re looking for:

- Step 1: Calculate gross pay

- Step 2: Calculate employee tax withholdings

- 2019 or prior

- 2020 or later

- Step 4: Add on any expense reimbursements

- Step 5: Total it all up

Step 1: Calculating Gross Pay

Gross pay is the original amount an employee earns before any taxes are withheld.

For hourly employees, gross pay is the number of hours worked during the pay period multiplied by the hourly rate. For example, if your receptionist worked 40 hours a week at a rate of $20 an hour, his gross pay for the week would be 40 x $20, or $800.

Don’t forget to include any overtime pay, which is typically 1.5 times the normal pay rate when an hourly employee works more than 8 hours a day or 40 hours a week. In this example, your receptionist would earn $20 for each of the first 40 hours worked, plus $30 for the 41st and any additional hours during the week.

For salaried employees, who are exempt from the overtime rules, gross pay will generally remain unchanged each pay period. Simply divide their salary by the number of pay periods in a year. For example, if a manager earns an annual salary of $50,000 and receives a paycheck twice a month, gross pay each pay period is $2,083.33 ($50,000/12 months/2 monthly pay periods).

In addition to wages, gross pay includes any commissions, tips, and bonuses the employee earns.

Step 2: Calculate Employee Tax Withholdings

Once you’ve calculated an employee’s gross pay, use the information on the employee’s W-4 to determine how much income taxes need to be withheld from their wages. In most states, you’ll need to withhold for both federal and state taxes and FICA taxes from each paycheck.

In our example, we will look at a Florida employee who claims a single marital status and two dependents on their W-4. The employee earns a $50,000 annual salary and is paid twice per month (semi-monthly). Her gross pay per period is $2,083.33.

Is payroll tax the same as withholding?

Payroll taxes and withholdings may sound similar, but they’re two different things. Payroll taxes are the taxes that are owed by the employee and/or employer, while withholdings are the amount of pay that an employer withholds from their employee’s paycheck to cover the employee portion of payroll taxes. The payroll taxes that are withheld from employees’ paychecks are FICA taxes, which include both Social Security taxes and Medicare taxes.

Federal Income Tax (FIT): 2019 or prior

Federal Income Tax (FIT) is calculated using the information from an employee’s completed W-4, their taxable wages, and their pay frequency. Based on Publication 15-T (2024), Federal Income Tax Withholding Methods, you can use either the Wage Bracket Method or the Percentage Method to calculate FIT.

We will use the Percentage Method in our example, looking at tables found in the 2024 IRS Publication 15-T PDF file. You can open the file to follow our calculations below.

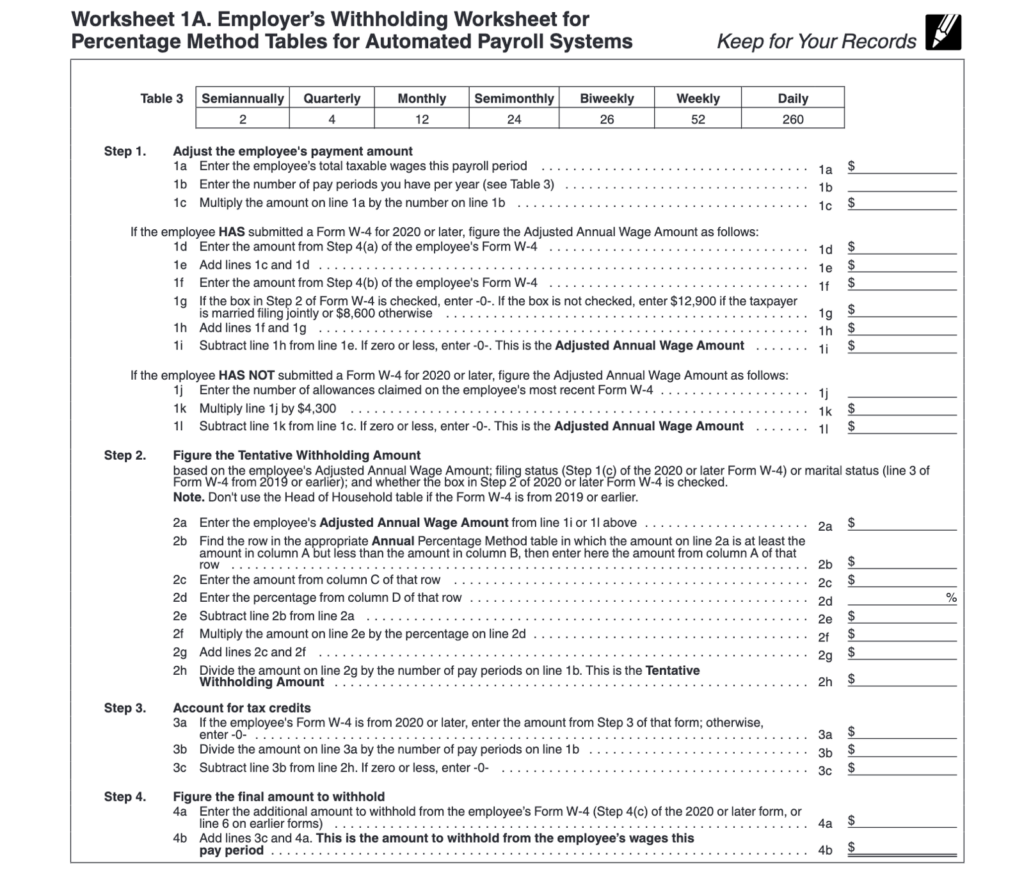

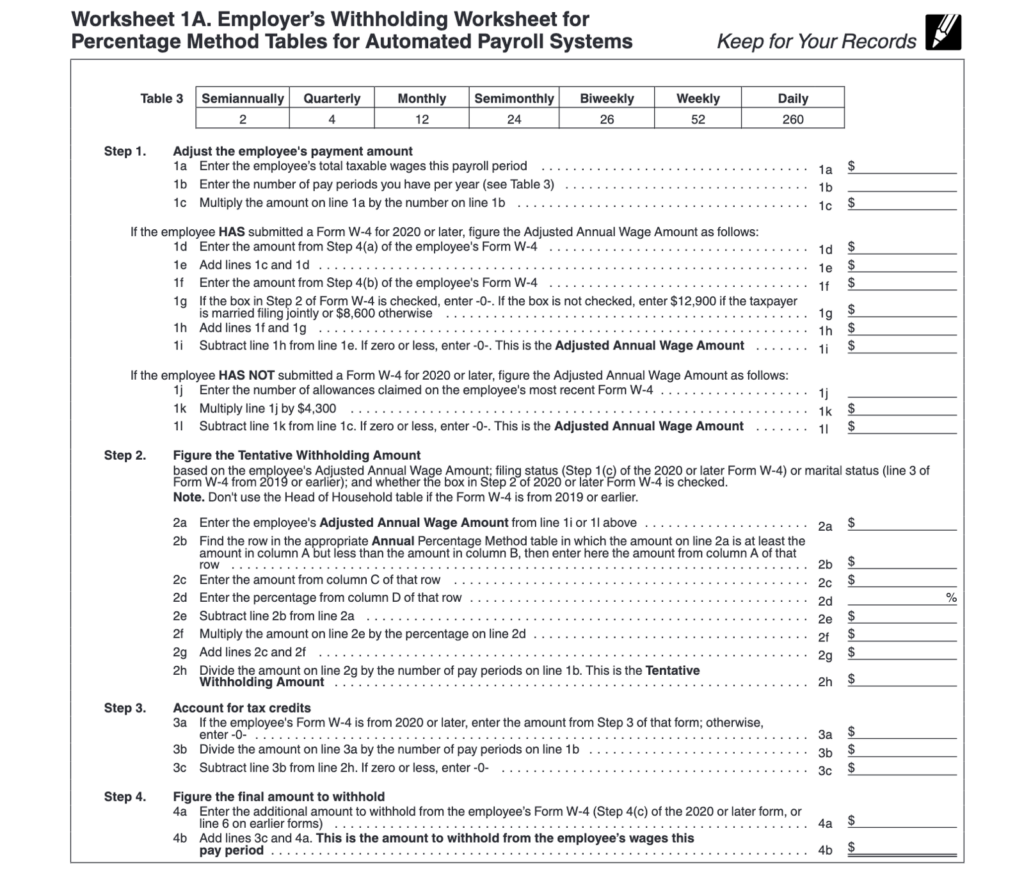

Using Worksheet 1 on page 9, we will determine how much federal income tax to withhold per pay period.

Step 1. Adjust the employee’s wage amount

1a) This is the same as gross wages: $2,083.33.

1b) Our employee is paid semi-monthly or 24 times per year.

1c) This should equal your employee’s annual salary: $2,083.33 x 24 =$50,000

Because we are using the 2019 W-4 form, we now skip to step 1j:

1j) Our employee has claimed 2 allowances

1k) $4,300 x 2 =$8,600

1l) $50,000 – $8,600 =$41,400

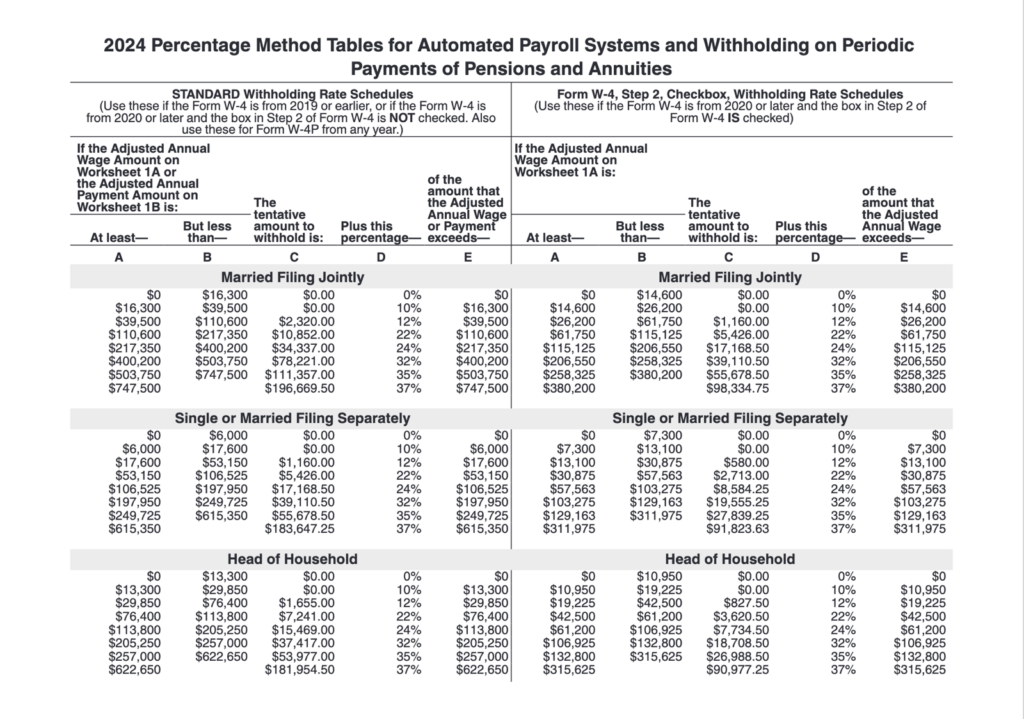

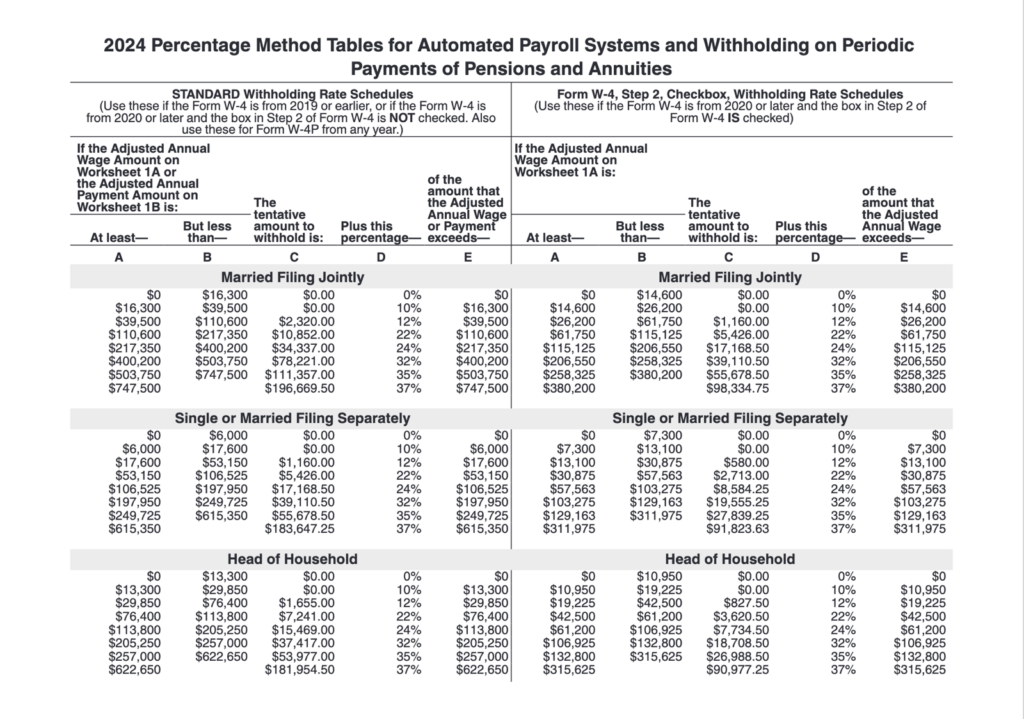

To continue, you will need to refer to the tax tables on page 11:

Step 2: Figure the tentative withholding amount

2a) This amount is from line 1l, $41,400

2b) We are referring to the table labeled “Single or Married Filing Separately” on the left (the form is from 2019 or earlier). Our employee’s adjusted annual wage amount ($41,400) is greater than $17,600 and less than $53,150. So, we would enter an amount of $17,600 (the amount from column A).

2c) The amount in column C is $1,160.

2d) The percentage from column D is 12%.

2e) $41,400 – $17,600 = $23,800

2f) $23,800 x 12% =$2,856

2g) $1,160 + $2,856 = $4,016

2h) $4,016 / 24 = $167.33

Step 3: Account for tax credits

3a) $0

3b) $0

3c) $167.33 – $0 = $167.33

Step 4: Figure the final amount to withhold

4a) $0 (there are no additional withholdings in this case)

4b) $167.33 + $0 = $167.33

There you have it. You will withhold $167.33 of federal income tax for this employee using the W-4 from 2019 and earlier.

Federal Income Tax (FIT): 2020 or later

Federal Income Tax (FIT) is still calculated using the information from an employee’s completed W-4, their taxable wages, and their pay frequency. In fact, not much has changed until you get into the withholding math. Looking at Publication 15-T (2024), Federal Income Tax Withholding Methods, you can use either the Wage Bracket Method or the Percentage Method to calculate FIT.

We will use the Percentage Method in our example, referencing tables that are found in the 2024 IRS Publication 15-T PDF file. You can open the file to follow our calculations below.

Using Worksheet 1 on page 9, we will determine how much federal income tax to withhold per pay period.

Step 1. Adjust the employee’s wage amount

1a) This is the same as gross wages, so as we calculated before, the amount is $2,083.33.

1b) Our employee is paid semi-monthly or 24 times per year.

1c) This should equal your employee’s annual salary: $2,083.33 x 24 = $50,000

Because we are using the 2020 W-4 form, we would now continue to step 1d:

1d) Our employee does not have any additional income, so this amount is $0.

1e) $50,000 + $0 =$50,000

1f) We are only withholding standard deductions so this equals $0.

1g) We would not check the box because our employee does not have more than one job, and because she claims a single marital status, this amount is $8,600.

1h) $8,600 + $0 = $8,600

1i) $50,000 – $8,600 = $41,400

To continue, you will need to refer to the tax tables on page 11:

Step 2: Figure the tentative withholding amount

2a) This amount is from line 1i, $41,400

2b) We are referring to the table labeled “Single or Married Filing Separately” on the left (using the 2020 W-4 and the box in step 2 is not checked). Our employee’s adjusted annual wage amount ($41,400) is greater than $17,600 and less than $53,150, so we would enter an amount of $17,600 (the amount from column A).

2c) The amount in column C is $1,160.

2d) The percentage from column D is 12%.

2e) $41,400 – $17,600 = $23,800

2f) $23,800 x 12% =$2,856

2g) $1,160 + $3,300 = $4,016

2h) $4,016 / 24 = $167.33

Step 3: Account for tax credits

3a) Our employee is claiming two dependents, each worth $2,000. $2,000 x 2 = $4,000

3b) $4,000 / 24 = $166.67

3c) $167.33 – $166.67 = $0.66

Step 4: Figure the final amount to withhold

4a) $0 (there are no additional withholdings in this case)

4b) $0.66 + $0 = $0.66

There you have it. You will withhold $0.66 of federal income tax for this employee based on the new Form W-4.

This is a significant difference from the 2019 W-4 withholding amount of $167.33 but is designed to help your employees have a more accurate amount of tax withheld from each paycheck.

FICA Taxes

The Federal Insurance Contributions Act (FICA) taxes are Social Security and Medicare, which are required to be withheld from all employees unless otherwise exempt.

- Social Security is a flat 6.2% withholding tax for wages up to $168,600 for the 2024 tax year. Any annual wages above $168,600 are exempt, which means that the cumulative annual Social Security withholding cannot exceed $10,453.20 ($168,200 x 6.2%). For our example employee, we would take their gross wage of $2,083.33, multiply it by 6.2%, and withhold $129.17 from their paycheck.

- Medicare is also a flat tax, at a rate of 1.45%. There is no annual limit for Medicare taxes, but employees who earn more than $200,000 a year are subject to what’s called the Additional Medicare Tax of 0.9%. We multiply our employee’s gross wage of $2,083.33 by 1.45% and arrive at $30.21 for Medicare tax.

Our employee’s FICA tax per pay period is thus $129.17 + $30.21 = $159.38.

Keep in mind that the other half of FICA taxes must be paid by employers (in this case, you!). That means that you’re responsible for paying $159.38 in Social Security and Medicare taxes every time you withhold $159.38 from your employee’s paycheck.

State and Local Taxes

Some states (like Florida) have no state income taxes, so you may be off the hook. But if you’re required to pay state taxes (see state-by-state tax info here), you’ll want to make sure your calculations are done right.

Different states apply payroll taxes in different ways, but once you know how to calculate the FIT and FICA taxes, calculating state taxes is a similar exercise.

Also, be sure to check whether your state imposes local taxes that are paid on top of federal and state taxes.

Step 3: Take Care of Deductions

In addition to withholding for payroll taxes, calculating your employees’ paycheck also means taking out any applicable deductions.

There are voluntary pre and post-tax deductions like health insurance premiums, 401(k) plans, or health savings account contributions. Some employees also have involuntary deductions that may need to be considered for items like child support or wage garnishments (you’ll know if you need to withhold these things because you’ll receive an order from a judge, the IRS, or the state).

Be careful here, because pre-tax deductions like 401(k) are taken out of gross income in Step 1, which means that the tax withholding calculation in Step 2 will be lower. Post-tax deductions are taken out after Step 2. Pre-tax deductions will save the employee more taxes.

Step 4: Add on Any Expense Reimbursements

If your employee paid for any company expenses out of their own pocket, they expect to be reimbursed. Employers can either pay reimbursements separately from payroll or combine it with payroll.

Remember that expense reimbursements are not part of gross wages, and thus not subject to tax withholding. Any expenses you reimburse to employees should be made in full and added on to net pay at the end of your calculation.

Step 5: Total It All Up

Once you’ve done all the math to figure out gross pay, tax withholdings, deductions, and reimbursements, you’ll have what you need to calculate the paycheck:

- Start with gross pay

- Subtract employee tax withholdings

- Subtract deductions

- Add on any expense reimbursements

- And you get net pay!

Now you know exactly how much money you will send your employee on payday!

Let’s review our example using the 2019 W-4 or prior:

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employee’s federal income tax withholding is $167.33 using the old W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employee’s net pay is $1,756.62.

Let’s review our example using the 2020 W-4 or after:

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employee’s federal income tax withholding is $0.66 using the new W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employee’s net pay is $1,9231.29.

From time to time, there may be other things you’ll need to add (like bonuses) or deduct (like garnishments and levies) from your employees’ paychecks. When these items are added and subtracted, the rest of the basic math outlined above stays the same.

Tool to try

If you are looking for more help with the steps we went through above, try OnPay’s free payroll taxes calculator which and makes it easy to crunch the numbers with just a few clicks.

Calculating employer payroll taxes

In addition to the taxes you withhold from an employee’s pay, you as the employer are responsible for paying certain payroll taxes as well:

- FICA Matching: You are required to match the employee’s FICA tax withholding, which means your company will pay 6.2% tax for Social Security and 1.45% tax for Medicare. Using our example employee, you as the employer would pay a matching $129.17 for Social Security and $30.21 in Medicare, resulting in a $159.38 FICA obligation.

- Unemployment Taxes:You will also have to pay federal and state unemployment tax. Unemployment taxes are paid only by the employer, not the employee.

- Federal Unemployment Tax (FUTA) is 6.0% of the first $7,000 in wages you pay each employee each year. If your company is subject to state unemployment, you can receive a federal tax rate credit of up to 5.4%, which makes the effective tax rate 0.6%. Once an employee earns more than $7,000 in a calendar year, you stop paying FUTA for that employee in that tax year. Federal Unemployment: $2,083.33 x 0.6% = $12.50

- State Unemployment Tax (SUTA)varies by state. Consult with your state’s Department of Labor or Unemployment Revenue for tax rates, wage bases, and filing requirements. For this example, we will assume the employee has not yet been paid $7,000 year-to-date. We will use Florida’s unemployment tax rate of 2.7%. State Unemployment: $2,083.33 x 2.7% = $56.25

OnPay makes calculating payroll simple and stress-free. With just a few entries and clicks, I have everyone’s paychecks complete, can see what I owe in taxes, and it all happens automatically. I just print the pay stubs and give them to my employees.

— Rinda Myers, Kurb to Kitchen LLC

Making payments to the IRS

Just because you’ve calculated payroll and paid your employees doesn’t mean your job is done. You also need to send the taxes you withheld (i.e. FIT, FICA, state and local income taxes) to the respective taxing authority. For FIT and FICA, that is the IRS. For state and local income taxes, that is your state’s withholding tax agency.

Be sure to send both the taxes you withheld from your employee’s paycheck as well as the taxes that you as the employer are responsible for.

The timing of when you send the federal taxes depends on how much you pay employees, how frequently you pay them, and your lookback period (historical analysis of your payroll and past payments). The IRS Form 941, Employer’s Quarterly Federal Tax Return, provides details on how, when, and where to pay FIT and FICA.

The deadline to file Form 941 is the last day of the month following the end of a calendar quarter. For example, for the quarter ending on March 31st, Form 941 is due on April 30th. There are significant penalties for not filing this form, so don’t forget!

For state tax filings, you should contact your state’s withholding tax agency for filing requirements for state and local income tax rates. Each state is different.

One last thing

Good luck calculating those payroll taxes (and building your team)! If you ever have any questions, or feel like you might want to leave this particular action item to someone else, we make payroll really easy. Take a peek.

Take a tour to see how easy payroll can be.