More from our experts

Knowing the difference between gross pay vs. net pay is one of the most basic (but also the most frustrating) payroll puzzles. But, the good news is you’re in the right place, because we’ve created a simple guide to help you understand it — and how to calculate a paycheck by getting from one to the other. Spoiler alert: it’s all about those payroll deductions and withholding!

Key takeaways about net pay vs. gross pay

- Gross pay is the total earned before deductions, while net pay is what employees actually take home

- Deductions come in three types: pre-tax (401(k), health insurance), tax withholdings, and post-tax items

- Employers must match FICA contributions and submit all withheld taxes to the IRS

- Net pay calculations vary for salary vs. hourly workers, with overtime (1.5x) required over 40 hours worked

Pay close attention and you should have no problem avoiding payroll headaches (and IRS fines).

What is gross pay?

Gross pay, also known as gross wages, is the total amount of money an employee earns in a given pay period. Essentially, it’s the compensation you negotiated with your staffer during the hiring process, and it reflects their wages before any deductions or withholdings.

Naturally, the next thing we need to cover is net pay.

What is net pay?

Net pay is the amount you actually pay an employee after taxes, involuntary deductions, and voluntary deductions have been subtracted from their gross pay. You may also hear employers refer to is take-home pay too. You calculate net pay — again, this is the actual amount you pay an employee — by subtracting deductions and withholdings from the gross pay.

You still with us? Then let’s dig a little deeper.

What is the difference between gross pay and net pay?

The key difference between gross pay and net pay lies in deductions:

- Gross pay is what the employee earns without any deductions. it’s literally the complete (or raw) amount of wages they have earned without any deductions.

- Net pay is what the employee is actually taking home and seeing in a paycheck or bank account once the required and voluntary deductions and withholdings are made.

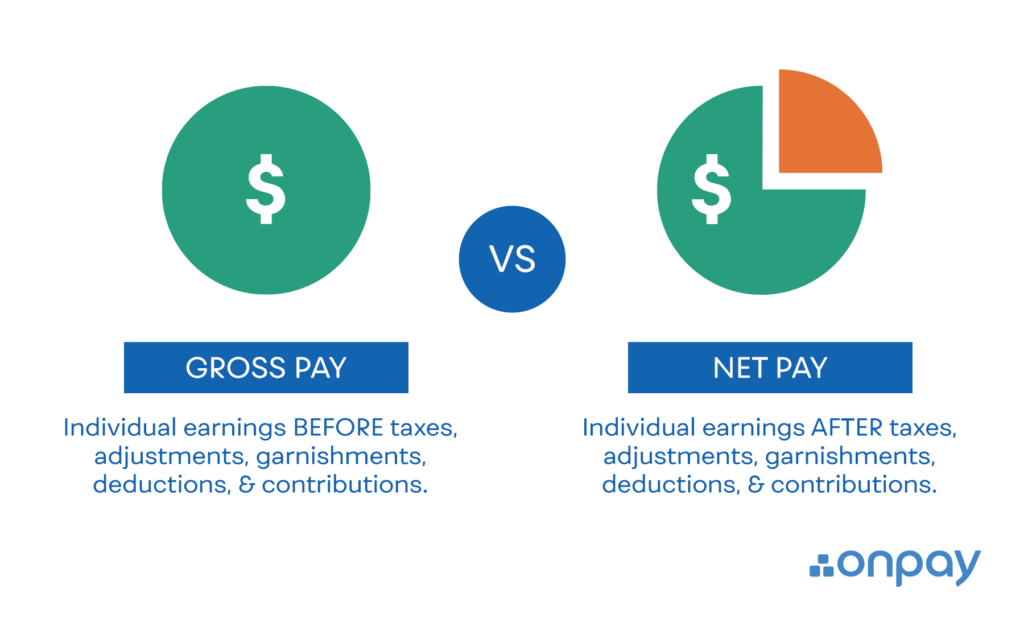

Gross pay vs. net pay illustrated

Calculating gross wages for salaried and hourly employees

Basic gross pay typically comes in two flavors: salary or hourly wages. Salary is based on annual compensation and is typically paid to professional employees, managers, and supervisors. For example, your accounting manager might be paid $85,000 per year. You can figure out gross pay by dividing an employee’s annual salary by the number of pay periods you have in a year.

Salaried employees are exempt from the Fair Labor Standards Act (FLSA), which means (among other things) that they are aren’t entitled to overtime wages. They are paid a set amount of money each pay period unless they receive additional compensation such as any commissions or bonuses.

Hourly wages are often paid to folks who do not have set shift times or a guaranteed number of hours weekly. For example, your barista might be paid $15 per hour.

They may or may not supervise other staffers, shifts, or projects, but the main difference between the salaried and hourly really just comes down to how they are compensated and whether or not you have to track and manage wages for any overtime they work.

Because, unlike salaried employees, hourly employees are considered “non-exempt employees”, you are typically required by law to pay them 1.5 times their hourly rate for overtime. Overtime is the hours worked in excess of 40 hours a week.

Hourly employees must track their hours worked by using some sort of timekeeping system or submit a timesheet so you can calculate their gross pay based on the hours worked each pay period.

Gross pay and pre-tax deductions

Gross pay is the jumping-off point for all payroll. So, let’s jump in!

Once you’ve calculated gross pay for the pay period based on salary or hourly wages, you’ll start here to subtract voluntary pre-tax deductions like 401(k) contributions, health insurance, or flexible spending accounts. These deductions reduce gross pay and consequently decrease the amount of tax withheld.

Let’s look at a quick example of some pre-tax deductions:

Your operations manager earns a salary of $100,000 per year. She elects to contribute 10% of her salary to your company’s 401(k) plan. Her portion of her health insurance premium is $500 per month. Here’s how that breaks down over the course of a year:

| Gross wages per year | $100,000 |

| 401(k) contribution | ($10,000) |

| Health insurance premium | ($6,000) ($500/month * 12 months) |

| Wages subject to tax | $84,000 |

Next, calculate taxes

Once you have wages subject to tax determined, you’ll need to calculate the following taxes:

- Employee’s federal income tax (FIT)

- Employee’s Social Security and Medicare taxes (FICA)

- Employee’s state and local income tax (SIT), if applicable

There are post-tax deductions, too

Post-tax deductions are subtracted from an employee’s net pay after taxes are taken out. Two common examples are disability insurance or garnishments, but you may also subtract things like parking fees or workplace giving.

For disability insurance, you’ll need to start deducting premiums when your employee signs up for coverage. For payroll garnishments, levies or child support, you’ll be notified by the court or government entity who orders the garnishment about how much to deduct and for how long. Precision counts here!

There are employer-only taxes you will pay

We dig into these in detail in how to calculate payroll, but here’s a quick overview.

Some of the easiest taxes to calculate are your matching contribution to Social Security and Medicare, collectively referred to as FICA taxes. All employees pay 1.45% of his or her gross wages for Medicare tax and 6.2% for Social Security tax. You, as the employer will pay a matching 1.45% and 6.2%.

For example, the operations manager above would pay $1,450 a year for Medicare tax and $6,200 a year in Social Security tax and you, as the employer, will send in the same amount.

Employee tax withholding

All new employees must complete IRS Form W-4, Employee’s Withholding Certificate, so you know the amount of federal income tax to withhold. Don’t forget: this form is for your records and isn’t sent to the IRS.

In 2019 or prior, the number of allowances the employee claimed, their tax filing status (single, married, etc.), and your payroll frequency (weekly, semi-monthly, bi-weekly, etc.) determines how much tax to withhold from each check. The calculation has multiple steps and can feel a little cumbersome. We recommend using a payroll calculator to make the calculations quickly and easily.

In 2020, the W-4 was revised. The new form has a five-step process and new Publication 15-T (Federal Income Tax Withholding Methods) for determining employee withholding. It no longer uses withholding allowances.

Navigating gross vs. net numbers

Since you’re reading about the differences between net and gross pay, we have resource you may find helpful. Try our net to gross calculator next.

How to calculate net pay

This is where it all comes together! Let’s walk through an example in a state without a state income tax:

- Jane, your operations manager, earns an annual salary of $100,000.

- She elects to contribute 10% of her salary to your company’s 401(k) plan.

- Her portion of health and dental insurance is $500 and $25 per month, respectively.

- She elects coverage under your company’s short-term disability insurance program at a cost of $50 per month.

- She claims 4 allowances on her W4 and is single.

- Your company processes payroll semi-monthly.

Here are the calculations:

| Gross salary | |

| $100,000/24 pay periods per year | $4,166.67 |

| Payroll frequency | Semi-monthly |

| Form W-4 | |

| Tax filing status | Single |

| Allowances claimed | 4 |

| Pre-Tax Deductions | |

| 401K (10% per year) | -$416.67 deduction |

| Health insurance | -$250.00 deduction per paycheck |

| Dental insurance | |

| $3487.50 Wages subject to tax | |

| Post-Tax Deductions | |

| Medicare tax | -$50.57 deduction |

| Social Security tax | -$216.63 deduction |

| Federal income tax | -$561.39 deduction |

| Short-term disability insurance | -$25.00 deduction |

| $2,633.91 Net pay to employee | |

Note: If you’re in a state with state income tax, you must also withhold and remit it to your state tax authority.

Make learning gross pay vs. net pay a priority

Congratulations! You’ve gotten from gross pay to net pay and are ready to pay your staffer. But don’t forget someone else who likes to get paid: the IRS. As an employer, you are responsible for sending the IRS the Social Security, Medicare, and Federal Income taxes you withhold from your employees. Failing to do so in a timely manner has rather severe and unpleasant consequences.

And if you want someone to handle payroll for you, you may want to check us out. We offer an easy, affordable online payroll service that does your payroll (including tax filings) for you.

Take a tour to see how easy payroll can be.