More from our experts

We surveyed over 1,000 small business owners to understand how they work with their accountant, what they expect, and how well they’re typically served. While we found that accountants and bookkeepers make a big difference for many small businesses, there are still opportunities to provide an even higher level of service.

Read on to get the downlow on how you can serve your clients best, or review our entire Small Business Finance and HR Report to learn more about what makes your small business clients tick.

Reliable and friendly

Our survey found that 82% of small business owners believe their accountant knows their business quite well. And when they were asked to describe their accountant, “reliable” and “friendly” were the most common descriptions they offered up.

So it shouldn’t be surprising that 86% of small business owners view their accountant as a trusted advisor — and that they’re more likely to turn to an accountant for business advice than any other external advisor (including lawyers, friends, or family).

Lots of things contribute to whether an accountant is viewed as a trusted advisor by small business owners. Most notably, trusted advisors tend to:

- Offer a wider range of services

- Know their clients better

- Interact with their clients more often

Breadth of services

On average, only 61% of small businesses are totally satisfied with the breadth of services their accountant offers. While almost all small business owners expect their accountant to help them with tax-related matters and bookkeeping, there’s also a good chance that many clients expect accountants to take on additional duties.

In fact, more than 25% of small businesses expect their accountant to help with each of the following financial and advisory services:

- Payroll (38%)

- Accounts payable/accounts receivable (37%)

- Financial projections (32%)

- Cash flow (27%)

- Choosing a business entity (26%)

- Business consulting (25%)

A significant number also expect their accountant to help with things like software recommendations, employee benefits, and HR.

The bottom line? Broadening your service offering helps improve client relationships. It cements your role as a trusted advisor, and it generates more revenue streams for your firm. Also note that adding new services can be done in different ways. For example, here’s a close look at how you could add a payroll service — even if you want to be hands off.

Communication

In our survey, small business clients prized frequent and proactive communication:

Nearly half of small businesses owners who work with a “trusted advisor” said they have contact with their accountant once a month or more. But overall, only 39% of all small business owners actually talk to their accountant that often.

Further highlighting the importance of communication, business owners who are thinking about switching accountants within the next year said they speak to their accountant less frequently than non-switchers, and they feel like their accountant doesn’t know them as well.

And while small business owners had a lot of nice things to say when we asked about traits they’d use to describe their accountants, there still were clear opportunities to contribute proactive insights — and to adopt more modern tools.

Grappling with COVID-19

Accountants’ trusted advisor role expanded through the COVID-19 epidemic. In particular, accountants really stepped up to help clients navigate COVID-19-related relief programs. And the added effort has made a big difference for them.

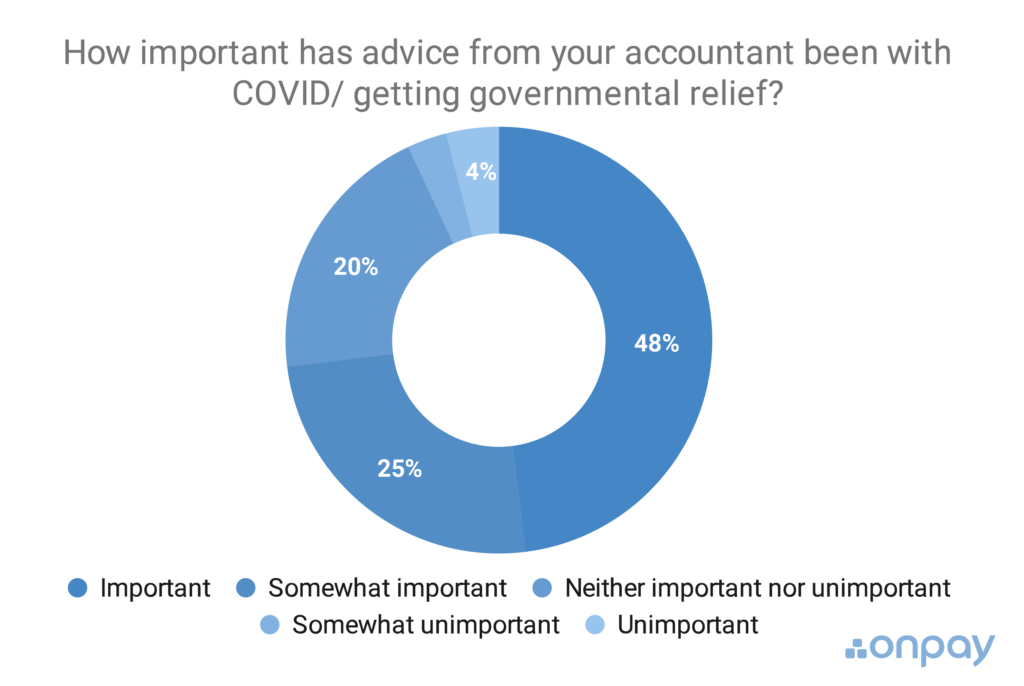

Another survey we conducted showed that 73% of small business with an accountant said their accountant’s help was at least somewhat important for navigating governmental relief programs:

Meanwhile, it seems that those small businesses without an accountant have not fared as well. They were less likely to:

- Expect an increase in revenue in 2020

- Expect business to return to normal soon

- Receive governmental relief

Given the complexity of navigating the relief programs and staying on top of COVID-19-related developments, it’s not surprising that accountants are playing an important role for their clients.

Opportunities to improve

We also saw that only 30% of small businesses use an external accountant, and that nearly a quarter of those businesses would consider switching accountants in the next year.

That means lots of opportunities to grow your practice, but also some risk, should you fall short of clients’ expectations. However you see it, there’s a good chance your clients want more from you.

Building a trusting relationship is the most important thing you can do, so make sure you have clear and frequent communication with clients. To do so, you might consider two big steps:

- Ask clients what services they expect from you

- Make sure you check-in with clients quarterly (or more often)

By doing so, you’ll keep your clients closer, and you may discover opportunities to build your practice by doing more for them.

Talk to us and see how easy it is to offer payroll services your way.