More from our experts

According to a LinkedIn study, more than 80% of small business owners outsource work to freelancers and independent contractors. There’s no single reason behind these findings: Some employers need to supplement their existing team’s skills (or resources), and recruiting top talent can be costly. Additionally, companies often opt to delegate tasks to outside consultants in order to prevent their in-house employees from experiencing burnout.

Fast facts about Form W-9

- Use IRS Form W-9 to request a vendor or independent contractor’s taxpayer identification number (TIN) and certification

- Employers must obtain a Form W-9 from any vendor or independent contractor they will pay more than $600 in a calendar year

- The payee, not the employer, must fill out Form W-9

- According to the IRS, a Form W-9 must be kept on file by employers for four years

Using external experts can also be a cost-effective way to get high-quality results without making a long-term commitment to a new employee. For instance, many businesses work with top-tier freelance copywriters and creatives on a project-by-project basis, because hiring them full-time could put a strain on the budget. Furthermore, some companies rely on assistance from independent contractors, such as accountants or occasional part-time help, to shore up schedules during their busy seasons.

If your business frequently relies on freelancers and independent contractors, you should definitely get familiar with Form W-9: Request for Taxpayer Identification Number and Certification. In this article, we’ll explain what the W-9 is used for and why it’s necessary when paying contractors or freelancers.

Form W-9 2024 (Revised March 2024) PDF download

This is the Request for Taxpayer Identification Number and Certification, which is the form you’ll share and ask freelancers and contractors to complete.

What is IRS Form W-9 used for?

Simply put, Form W-9 is an IRS form businesses use to gather essential information about the contractors and freelancers they occasionally employ. Form W-9 is not filed directly with the IRS. Instead, the information is kept on file by the employer and used to prepare year-end tax documents such as IRS Form 1099-NEC, which is sent to both the contract employee and Uncle Sam when tax time comes around.

If you’re unsure why a completed Form W-9 is necessary when outsourcing projects or hiring part-time help, let’s cover more details (and a common scenario.)

When do you need to use Form W-9?

Any time you hire a freelancer or independent contractor for your business, you should ask them to complete a Form W-9. It’s really a must-have, even if this person worked for a short period of time, because every time a business pays a freelancer or independent contractor a total of $600 or more during the calendar year, it is required to file information returns using Form 1099-MISC. Let’s illustrate with a scenario many employers run into.

Picture this: right in the middle of your busiest time of the year, many employees are calling in sick. Orders begin to pile up, and the idea of treading water until staffers return to full strength is risky. In order to temporarily relieve the bottleneck and ensure that orders are fulfilled, you decide to hire part-time help. Since they’ll only be assisting for a few weeks until your team members recover, you’re going to hire them as independent contractors — and before their start date, they’ll need to complete Form W-9.

Once you receive it, every completed W-9 should be kept on file since the information contained in the form will be used at year end to send out a 1099 to each independent contractor or freelancer you hired throughout the year.

Though the W-9 is for your records only and is not filed with the IRS, you will have to file an information return with the IRS by the due date that provides details of any 1099s you have issued.

Did you know?

Form W-9 can also be used for other purposes, such as reporting canceled debt, student loan information, or real estate transactions by banks and other financial institutions.

Who needs to fill out Form W-9?

You’ll need to have Form W-9 completed by a freelancer or independent contractor before they begin working for your company. And as important as it is to an employer that a worker fill out the W-9 accurately, it’s just as important to the contractor. A W-9 filled out incorrectly (or not received at all) can lead to delays in processing 1099s at year end, which can negatively affect both business owners and independent contractors.

You’ll need to have Form W-9 completed by a freelancer or independent contractor before they begin working for your company. And as important as it is to an employer that a worker fill out the W-9 accurately, it’s just as important to the contractor. A W-9 filled out incorrectly (or not received at all) can lead to delays in processing 1099s at year-end, which can negatively affect both business owners and independent contractors.

To learn more, we spoke with Navi Maraj, a CPA and small business accountant about helping those you hire understand why completing a W-9 is worth the time. “An analogy I like to use when explaining Form W-9 and Form 1099 to new contractors or freelancers is to compare these forms to Form W-4 and Form W-2,” he explains. “Most people will likely be familiar with each of these forms from when they were employees working for an employer.”

The information added to the W-4 is used to obtain an employee’s name, social security number, address, tax filing status, and how much income tax to withhold from their future paychecks. The employer then issues the employee Form W-2 after the calendar year is over.

Similarly, a business will request Form W-9 to be completed by an independent contractor before the contractor begins work. “Based on the way the W-9 is completed by the contractor, the business will know whether or not it is required to issue the contractor Form 1099,” says Maraj. If required, Form W-9 provides the business with all of the information it needs to accurately issue the 1099.

Backup withholding

The process of “backup withholding” is one of the unfortunate consequences that can result from information submitted to the IRS that does not match IRS records. The IRS requires that businesses impose and remit a 24% backup withholding tax on all future payments made to a contractor until the IRS receives the correct information.

Examples of payments that may be subject to backup withholding include (but are not limited to): rents, royalties, and interest. The main takeaway is that getting W-9s completed prior to an employee’s start date, completely — and accurately — should go a long way toward reducing the likelihood that a company will need to use a backup withholding.

Furthermore, most contractors and freelancers want to avoid this step and are likely to complete Form W-9 for you without any fanfare.

“Based on the way the W-9 is completed by the contractor, the business will know whether or not it is required to issue the contractor Form 1099.”

— Navi Maraj, CPA

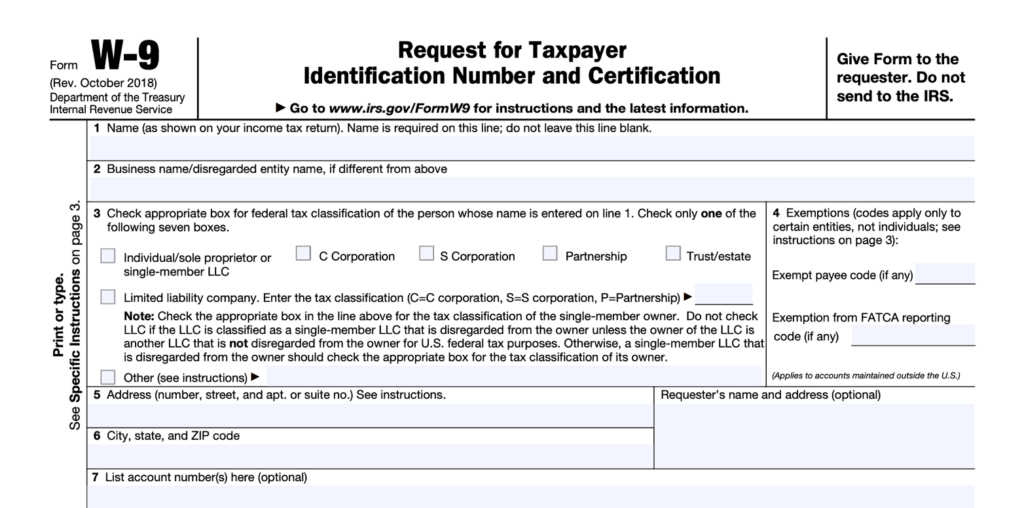

What information is needed to complete Form W-9?

Form W-9 is a simple one-page form that includes detailed instructions. Freelancers and independent contractors should fill out the top part of the form first, with the following information needed:

- Name (as shown on your tax return)

- Business name, if different from name above

- Check the appropriate box for the federal tax classification: Classification options include:

- Individual/Sole Proprietor or Single-Member LLC

- C Corporation

- S Corporation

- Partnership

- Trust/Estate

- Any appropriate exemption codes for entities, not individuals

- In most circumstances, the exemptions box is left blank. The rare exceptions to this rule include corporations that are exempt from backup withholding and payees who are exempt from reporting according to the Foreign Account Tax Compliance Act (more on this below). It’s unlikely that either of these boxes will apply to the typical independent contractor or freelancer. Note: It is always a good idea to reach out to your account or tax professional if you’re unsure of your obligations.

- Address

- City, state, and ZIP code

- List account numbers (optional). In many cases, you’ll leave this section blank unless you have a specific need for freelancer or independent contractor bank account information. Note: If you’re unsure if this section applies to you, get in touch with a trusted accountant or tax specialist.

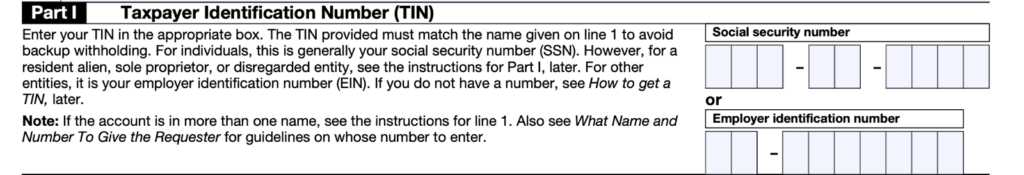

Part I of the form is where the individual would enter their taxpayer identification number (TIN) which is either the worker’s Social Security number or Employer Identification Number.

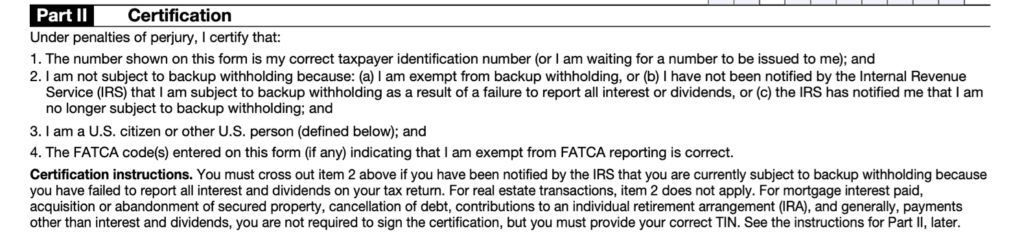

Part II of the form is where the individual certifies:

- That the taxpayer identification number (TIN) listed is correct the number

- That they are not subject to backup withholding

- That they are citizens of the US

- That any FATCA* code entered on the form is correct

*If you’re seeing the acronym FATCA for the first time and wondering what it means, here’s a quick primer. FATCA stands for the Foreign Account Tax Compliance Act and is a law that requires U.S. citizens living at home or abroad to file annual reports on any foreign account holdings they have. The purpose is to end tax evasion by American individuals and businesses who invest, operate, and earn taxable income abroad.

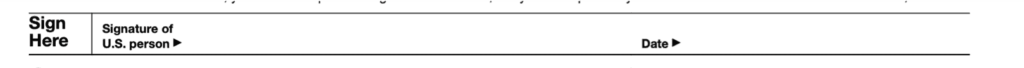

The last step requires the freelancer or independent contractor to sign and date the form and return it to the requester to keep it on file. Remember, neither the individual completing the form nor the business or entity requesting it is required to file the form with the IRS.

Completing Form W-9 is a straightforward process, but if the parties involved choose not to stay on Uncle Sam’s good side, there can be repercussions.

Penalties for non-compliance with Form W-9

As you may have guessed, not complying with Form W-9 can add up to some less-than-positive — and easily avoidable — outcomes, including penalties for both businesses and individuals.

- Criminal penalties – Providing false information on a W-9 can result in criminal penalties which can include fines and, in some cases, even prison.

- Monetary penalties – Failure to complete a W-9 or refusing to complete one can result in a monetary penalty for vendors and contractors alike.

- Backup withholding – A vendor or independent contractor providing erroneous information on a W-9 (or not providing a completed W-9) is subject to backup withholding of 24% of earnings on all future payments.

Freelancers and independent contractors aren’t the only ones that can be penalized. Business owners can face penalties as well, for multiple reasons:

- Not having a signed W-9 form on file or the refusal by a contractor or vendor to provide a signed W-9 does not excuse a business from filing timely.

- Misuse of the information provided on a W-9 including a TIN or Social Security number can result in both civil and criminal penalties.

- Filing 1099s late or not at all both carry penalties, as does filing erroneous information, with fines ranging from $50 to $350 per 1099.

User-friendly for everyone

OnPay makes it so easy to run payroll and I love the fact that I can pay employees using direct deposit payroll, as well as have independent contractors and new employees add their information directly into the system, without the need for outside help.

— Leanne Rubenstein, Compassionate Atlanta, Inc

Make Form W-9 a priority

Owning a business can be very rewarding, but being your own boss does come with a lot of responsibilities. Some days, it may seem like the number of employee payroll forms that need to be completed is neverending. The good news is that Form W-9 is one of the easiest forms you’ll need to deal with — it takes only a minute or two to have a worker complete — and you don’t have to do anything with the form right away.

But come year end, having that completed form on file will be time well spent and can prevent penalties in the future. If an independent contractor or vendor refuses to provide a signed W-9, explain to them why it’s necessary. If they still balk, it might be a good idea to look elsewhere.

Please note all material in this article is for educational purposes only and does not constitute tax or legal advice. You should always contact a qualified tax, legal or financial professional, in your area for comprehensive tax or legal advice.

Take a tour to see how easy payroll can be.