More from our experts

Many businesses are able to reduce their tax liabilities by using Form 8832 to change their tax election status in the eyes of the IRS. In some cases, there’s even the potential to save thousands of dollars in taxes during the year. However, changing your designation is not as simple as snapping your fingers and that’s why we put together the form 8832 instructions below so you can make an election.

Fast facts about Form 8832

- The purpose of IRS Form 8832 is to elect how a business will be classified for federal tax purposes.

- Filing an 8832 gives you the option of being taxed as a sole proprietor, a partnership, or a C corporation.

- Typically once you make an election on Form 8832, you must continue to file as that entity for a minimum of 60 months (unless the IRS consents to a change).

- File your form by mail because it’s not possible to file online or by fax. The IRS provides a list of mailing addresses based on where your business operates.

If you and your tax advisor have done your homework and agreed on a course of action, here’s everything you need to know to make an 8832 election.

What is IRS Form 8832?

IRS Form 8832 is used by a business to elect — or change — how it will be classified for federal tax purposes including as a corporation, partnership, or a disregarded entity.

For example, if you currently have a Limited Liability Company (LLC), but prefer to be taxed as a C Corporation, you would fill out and submit Form 8832. It can also be used if your LLC is currently being taxed as a C Corporation, but you would rather be taxed as a partnership or sole proprietor.

Form 8832 – Entity Classification Election – Downloadable PDF

Use the link above to download Form 8832. Below are more details on who is eligible to file it, how to complete, and how to send it to the IRS.

Who is eligible to make an 8832 election?

Partnerships and both single-member and multiple-member LLCs are eligible to file Form 8832. Certain foreign entities are eligible to file this form, and LLCs can also file Form 8832 if they wish to revert back to a previous tax classification.

Please note that your business can only change it’s tax classification once every five years, so you should be prepared to stick with your decision — and you probably shouldn’t change your status to take advantage of short-term tax savings. Please consult your tax advisor before making an election.

Who is not eligible to file Form 8832?

Sole proprietors are not eligible to make an 8832 election. Corporations are also generally not eligible to file — with the exception of LLCs that previously chose a corporate tax status and wish to change their classification.

Why file Form 8832?

If you’re happy with your current tax status, you won’t need to file this form. But many LLCs can reduce their tax burden by changing the default tax status they were assigned when they were formed.

If you and your accountant determine that it’s financially advantageous to change your default tax status, filing an 8832 gives you the option of being taxed as a sole proprietor, a partnership, or a C corporation.

What is the Form 8832 filing deadline?

There is no formal deadline for filing Form 8832, but when you file it, it can have implications on when your new tax classification kicks in. For instance, your new classification cannot take effect more than 75 days prior to the date the election is filed or later than 12 months after filing, according to the IRS.

Form 8832 Instructions and PDF

What you’ll need:

Form 8832 – Downloadable PDF

Your business information including name, Employer Identification Number (EIN), and address. There are also several options to update your information including:

- If you’ve moved since applying for an EIN or filing your most recent return, check the Address change box.

- If you qualify to file the classification late, check the Late-classification relief sought under Revenue Procedure 2009-41 box.

- If you’re requesting late election relief, check the Relief for a late change of entity classification election sought under Revenue Procedure 2010-32 box.

Part I – Election Information

Line 1 – Type of election

- Box 1a: Check this if you’re requesting an initial classification.

- Box 1b: Check this if you’re requesting a change in your classification.

Line 2a – Indicate whether you have filed an entity election within the last 60 months. If yes, go to line 2b; if not, go to line 3.

Line 2b:

- Yes – Check if your prior election was an initial classification. If the Yes box is checked, you should go to line 3.

- No – If this box is checked, you are not currently eligible to make an election.

Line 3 – Indicate whether there is more than one owner of your business. If yes, you can elect to be classified as a partnership or association that is taxable as a corporation. If no, you can elect to be classified as an association taxable as a corporation or you can choose to be disregarded as a separate entity.

Line 4 – Provide the name and EIN of the single owner.

Line 5 – Provide the name and EIN of the parent corporation, if owned by one or more affiliated corporations.

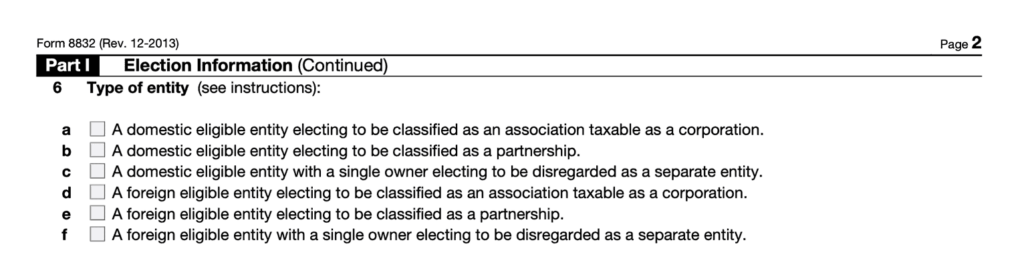

Line 6 – Choose the type of entity you want to elect, with options available for both domestic and foreign entities. The choices available include:

- Box a: A domestic eligible entity electing to be classified as an association taxable as a corporation.

- Box b: A domestic eligible entity electing to be classified as a partnership.

- Box c: A domestic eligible entity with a single owner electing to be disregarded as a separate entity.

- Box d: A foreign eligible entity electing to be classified as an association taxable as a corporation.

- Box e: A foreign eligible entity electing to be classified as a partnership.

- Box f: A foreign eligible entity with a single owner electing to be disregarded as a separate entity.

Remember you are limited to one change in tax status every five years, and an error here can be costly. So, be sure that the option you choose on your 8832 is the correct one.

Line 7 – If a foreign entity is chosen, you must provide the name of the foreign country.

Line 8 – Indicate the date you wish the election to become effective. Remember, the date can generally be no sooner than 75 days before you file Form 8832 and no later than 12 months after you file Form 8832. If the date field is left blank, the IRS will use the form submission date as the effective date.

Line 9 & 10 – Name and telephone number

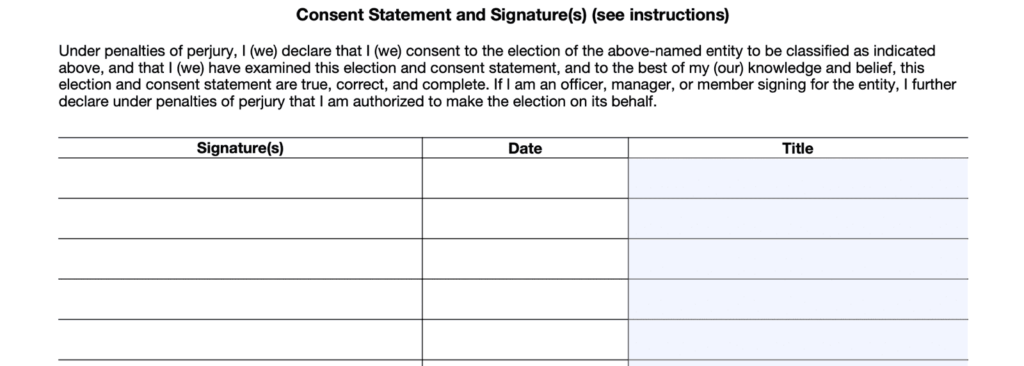

Signature — Complete and sign the Consent Statement with an authorized signature, date, and title. Those authorized to sign Form 8832 include all current owners of the entity or an authorized officer or manager.

Form 8832 (Part II) Late Election Relief

This part of Form 8832 is only required if you are seeking late election relief (otherwise, you may skip it).

Line 11 – Explanation of why Form 8832 was not filed on time

An entity may be eligible for late election relief in certain circumstances — all four must apply:

- A previously submitted 8832 was denied because it was not filed in a timely fashion.

- Your tax deadline has not passed for the current year’s federal tax filing, or you are currently up to date on all federal tax filings.

- You can show reasonable cause why the classification election was delayed.

- It’s been less than three years and 75 days since the requested effective date of the election.

If your business meets these four requirements, you’ll need to explain the delay on line 11 of Form 8832. Part II will also need to be signed by an authorized representative of your business as well as each affected person. Anyone who signs the declaration must have personal knowledge of the events described on line 11.

And that’s it for the form! Once submitted, the IRS will notify you if your election is accepted — or not accepted — within 60 days.

Can I file Form 8832 online?

Unfortunately, filing form 8832 online is not an option. Faxing the form is not possible, either. Use the list below, which is provided by the IRS, to determine where you need to mail your completed form based on the state where you do business.

In addition per the IRS: “Also attach a copy to the entity’s federal income tax return for the tax year of the election.”

Take a tour to see how easy payroll can be.