More from our experts

Form 2553 allows you to file your business taxes as an S-corporation. Even though there are various benefits to filing taxes as an S-corporation (S-corp) — such as potential tax savings — there can be extra complexity with S-corp status, which you should be aware of before taking steps to file this form.

Fast facts about Form 2553

- Form 2553 is an IRS form that allows you to apply for subchapter S-corporation (S-corp) taxation status for your business

- Although many LLCs elect S-corp status, an LLC is not the same thing as an S-corp, and LLCs must complete a form (Form 2553) to enjoy S-corp taxation status

- There are additional rules and filing requirements that might offset S-corp tax savings. Consulting with a tax professional will help you determine the right time to file Form 2553

In this guide, we will outline exactly what Form 2553 is, who can file it, how to file it, plus the potential advantages and disadvantages — of S-corp status.

What Form 2553 is used for

Simply put, Form 2553, or Election by a Small Business Corporation, is a tax form issued by the Internal Revenue Service that is used by businesses previously structured as a C-corporation (C-corp) or limited liability company (LLC) to elect S-corporation (S-corp) taxation status. It’s important to note that your business must have one of these structures in place before filing Form 2553.

Getting familiar with Form 2553

The purpose of Form 2553 is to notify the IRS that you want to have your business profits taxed on a pass-through basis. We will go over exactly what that means later in the article, but in the meantime, here’s a good rule of thumb:

Assuming your bookkeeping is accurate, if your net profit on your P&L is $30,000 or more, it could be worthwhile to talk to your tax professional about completing Form 2553 and electing S-corp taxation status.

Again, this is a rule of thumb. Every person’s tax situation is different, and factors such as your total personal income, the state where you live, and other tax considerations must be weighed before deciding if filing Form 2553 is the best step to take. Regular consultations with your tax professional will ensure you file Form 2553 at the optimal time.

Even if your business is very young or on the smaller side, you want to plan for growth and profitability. You might not be ready to file Form 2553 now, but being aware of the tax-savings benefits of S-corp election will help you know when to consult your tax advisor.

Who is eligible to file Form 2553?

Simply put, not every business can take advantage of an S-corp election. For example, if your business is a sole proprietorship, making an S-corp election without first organizing it as an LLC or a C-corp isn’t possible.

That said, there are other requirements you must meet to be eligible for S-corp status, and Uncle Sam provides a comprehensive checklist in their Instructions for Form 2553. To sum up, they are:

- Be organized as an LLC or C-corporation, which is based and operating in the United States

- Have 100 or fewer shareholders

- Keep in mind that these shareholders must all be individuals, estates, exempt organizations, or certain trusts. Shareholders cannot be partnerships or other corporations.

- Have no nonresident alien shareholders

- Have only one class of stock, meaning your business cannot have both common and preferred stock

- Being a bank, insurance company, or domestic international sales corporation is not allowed

- All shareholders must consent — by the signed statement included on Form 2553 — to S-corp election status

- Define a fiscal tax year. For most businesses, this will be the calendar year

We cannot stress this enough: Even if you meet all of these requirements, speaking with a tax professional before filing Form 2553 makes a lot of sense. Your business may be straightforward, but filing Form 2553 subjects you to rules and requirements that — if not met —can result in penalties that more than erase the tax savings of S-corp taxation status.

Moving on, let’s cover some of the possible positives that come with completing this form.

Potential benefits of filing Form 2553

Earlier, we alluded to the potential tax benefits that can follow once filing Form 2553. In some cases, S-corp election status can save you — and your business — money on taxes, and how that happens depends on your current business structure.

An important note: We provide examples for each of the potential scenarios provided below. The examples use simplified calculations based on assumptions that may or may not apply to your tax situation (and not based on a specific business or industry). Additionally, the examples only consider federal taxes; state and local taxes could have a significant impact on these calculations.

C-corporations

Is your business organized as a C-corporation? You might have heard the dreaded term “double taxation” when meeting with your accountant, but maybe you’re still unclear on how that works and what it means.

Unlike other tax structures, C-corporations pay corporate income taxes on their business profits. This is the first time the profit is taxed. Whenever those profits are distributed to shareholders – or owners – in the business, each shareholder/owner pays personal income tax on the distributed profits. That is where double taxation comes into play.

Large corporations with thousands of shareholders might not care so much about double taxation. After all, most of their shareholders are likely far removed from the business. But for small business corporations with just a few shareholders, double taxation often hits very close to home (and pocketbook).

C Corporation example

For instance, let’s say you and two business partners own and work in your C-corp. Things are picking up, and after your business generates $210,000 in profits, the decision is made to distribute that full amount equally among the three of you. However, there’s a detail that comes with this decision that’s hard to ignore: Your business not only has to pay taxes on $210,000, but you and your business partners also have to pay taxes on the $70,000 in distributed profits.

At the current corporate tax rate of 21%, the corporation would owe $44,100 in taxes. Assuming you and your partners are taxed at 15%, you would owe $10,500 each, or $31,500 combined. The total tax, then, would be $75,600.

Chances are, one — if not all three — of you are going to feel the burden of this “double taxation.”

Limited Liability Companies

By default, limited liability companies (LLCs) are considered “disregarded entities” from a tax perspective, meaning that the owners are considered self-employed or sole proprietors. It’s important to remember that the business owners of a disregarded entity are not included on the payroll. Instead, they take draws or distributions from the business, and no taxes are withheld from these payments to the business owner.

Instead of having “normal” payroll tax deductions (we’re referring to things like income taxes, Social Security, and Medicare taxes that are withheld from an employee’s paycheck and remitted to the appropriate tax agency), owners of disregarded entities have to make estimated quarterly tax payments using Form 1040-ES throughout the year. They’re also responsible for paying self-employment tax: Social Security and Medicare tax that, under a traditional employment model, the employer contributes on behalf of the employee.

Last but not least (and it may feel a bit like putting salt in a wound), disregarded entity owners’ tax payments are calculated on the full amount of the LLC’s profits – not the amount they withdrew from the business.

Yes, this is a lot to juggle, so here’s an example to make this less complicated.

LLC example

Let’s say you are the sole owner of an LLC, your business generated $120,000 in profit last year, and you withdrew $60,000.

Now, if you had been an employee who was paid a salary of $60,000, your income tax would have been a percentage of $60,000, and that percentage would have been withheld from your paycheck (meaning you wouldn’t have seen that money in your bank account). In addition, 7.65% of your $60,000 salary — or $4,590 — would have been withheld for Social Security and Medicare taxes.

But, since you are the owner of a disregarded entity, your income tax is a percentage of your business’s entire $120,000 profit — not just the $60,000 you withdrew from the business. Plus, you owe 15.3% of $120,000 – or $18,360 – for Social Security and Medicare taxes.

And, since these taxes did not end up getting withheld from any payment you took from your business, you guessed it: they are out-of-pocket expenses you’re responsible for.

Now that we’ve gotten those explanations out of the way, it’s not all gloom and doom. Moving on let’s get into the dynamics of tax savings for each of these examples.

How S-corp election saves money on taxes

S-corps are what are known as pass-through entities. This means that the business’s profits pass through to the shareholders (owners) of the business. Then, the shareholders pay the taxes on those profits.

So now you may be thinking: How does that help with taxes? Let’s go back to the examples we just touched on:

C-corp that makes S-corp tax election

Remember in the earlier scenario that your business generated $210,000 in profits, and you decided to distribute that equally among the three shareholders in your business? Under C-corp status, the corporation paid taxes on the $210,000, and then you and your business partners also paid taxes on the $70,000 distributed to each of you in profits.

After you make an S-corp election, the entire $210,000 in profits is passed along to the shareholders. Assuming each shareholder has an equal stake in the business, you each will still need to pay taxes on $70,000. However, that is the only tax due; the $44,100 tax that the C-corp paid in our original example is no longer due.

Disregarded entity that makes S-corp tax election

In our earlier scenario, you may recall that your business generated $120,000 in profit last year, and you withdrew $60,000. You had to pay 15.3% for Social Security and Medicare taxes on the $120,000 in profit, plus income tax.

After you make an S-corp election, you put yourself on payroll (this is a requirement for S-corp owners; more on that later) and pay yourself a salary of $40,000. This immediately reduces your taxable profit by $40,000 because your salary is now considered a business expense.

Income tax is withheld from this $40,000, as is Social Security and Medicare. But since you are now considered an employee of your business, the 7.65% employer’s contribution of Social Security and Medicare — or $3,060 — is paid by the business, further reducing the taxable profit.

Let’s pause for a moment here. You might be crunching these numbers and thinking,“Wait a minute. I drew $60,000 out of my business as a disregarded entity. Now I’m only getting paid $40,000, AND taxes are being withheld? How exactly is this better?” – we’re almost there!

As an S-corp shareholder, you get to take distributions as well as a salary. And those distributions are only subject to income tax, NOT Social Security and Medicare taxes. So, let’s say you decide to take $35,000 in distributions to offset the taxes withheld and make up the difference between the $60,000 you drew as a disregarded entity and the $40,000 salary you are paying yourself.

So, to recap:

- You had $120,000, reduced by the $40,000 salary you paid yourself and the $3,060 in Social Security and Medicare taxes. This gives you a taxable profit of $76,940.

- You took a $35,000 distribution from the business in addition to your salary.

Since you have made an S-corp election, the taxable profit of $76,940 flows through to your personal tax return. Assuming you had no income aside from your $40,000 salary, your total taxable income before deductions is $116,940.

But remember: you have already had income tax withheld on your salary, plus the $76,940 is only taxed at your personal income tax rate. If you are in the 15% income tax bracket, the tax liability before deductions is $11,541 – a savings of nearly $7,000.

What about sole proprietorships not organized as an LLC?

We’ve covered the tax benefits to an LLC disregarded entity, or a C-corp for filing Form 2553 and making an S-corp election. But what about sole proprietorships?

Because LLC disregarded entities are taxed as sole proprietorships, a sole proprietor can expect similar tax savings as outlined for LLCs. If your business is a sole proprietorship, just remember you will need to organize it as an LLC before filing Form 2553.

So far, we have covered some of the potential benefits of filing Form 2553. Now we need to cover the flip side and some potential cons that individuals may want to consider.

Potential disadvantages of filing Form 2553

Although there are numerous tax advantages to filing Form 2553, there are some potential disadvantages you should consider before making an S-corp election for your business.

- Your business’s tax return will be more complicated. Form 1120-S, which is the form used to file an S-corp’s tax returns, is a significantly more complex form than Schedule C, which is the form used for a sole proprietorship’s tax return. As such, most tax professionals will end up charging more for S-corp tax filings. There’s a chance these additional filing fees could possibly offset some of your tax savings.

- Owners must be paid a “reasonable compensation” via payroll. S-corp owners, or shareholders, must be paid a reasonable salary; however, though the IRS has some guidance, they don’t exactly define what “reasonable compensation” is. A rule of thumb is that you should pay S-corp shareholders whatever you would pay someone else to do the same job they hold in your business. Should the IRS determine your compensation isn’t “reasonable” enough, they could reclassify some of your distributions as wages and then assess back taxes – and penalties and interest – on those wages.

- You must be careful your distributions don’t exceed your basis. If you distribute – or withdraw – from your S-corp more than your basis -— or the ownership you have in it — those excess distributions can be subject to capital gains tax.

In short, filing Form 2553 and electing S-corp status probably means you’ll need to rely more on your tax advisor to stay on top of compliance. Even though this will most likely result in higher professional fees, it can make sense to think of it as an investment: Not only should your business reap the rewards of tax savings, but you’ll also receive accounting guidance that can be put to good use down the road.

Now that we better understand some of the pros and cons, it’s time to talk about the best way to approach completing the form so you can submit it.

Filling out Form 2553

At only four pages long, Form 2553 is a relatively short tax form. However, “short” doesn’t necessarily mean “simple.” At first glance, it does appear to be straightforward enough for a business owner to complete without professional assistance. But appearances can be deceiving: the instructions for Form 2553 span six, densely-worded pages, and the IRS estimates it could take up to 17 hours to learn about Form 2553, complete it, and fulfill the recordkeeping requirements.

- Can you complete Form 2553 yourself? Yes, you can, especially if your business is small and relatively uncomplicated.

- But should you complete Form 2553 on your own? That’s a different story.

Your tax professional, on the other hand, should be well-versed in the nuances of completing this form and should take a fraction of the time.

Since you should seek their advice before making the S-corp election, anyway, it’s just as easy for you to engage your tax professional to complete Form 2553 for you. The money you pay them to do so will be money well spent. There’s also a matter of opportunity cost: Whatever you pay your tax professional to file Form 2553 will likely be much less than you could generate in the two working days the IRS estimates it will take the average taxpayer to complete the form properly.

Now that we have that disclaimer out of the way, let’s talk about the facets of the form and how it gets completed.

The four parts of Form 2553

Even though we recommend engaging a professional to help you file Form 2553, you will need to be able to provide some information to help them complete it correctly. To that end, let’s look at the four parts of Form 2553 and the information required for each part. You can download the form on the IRS’s website.

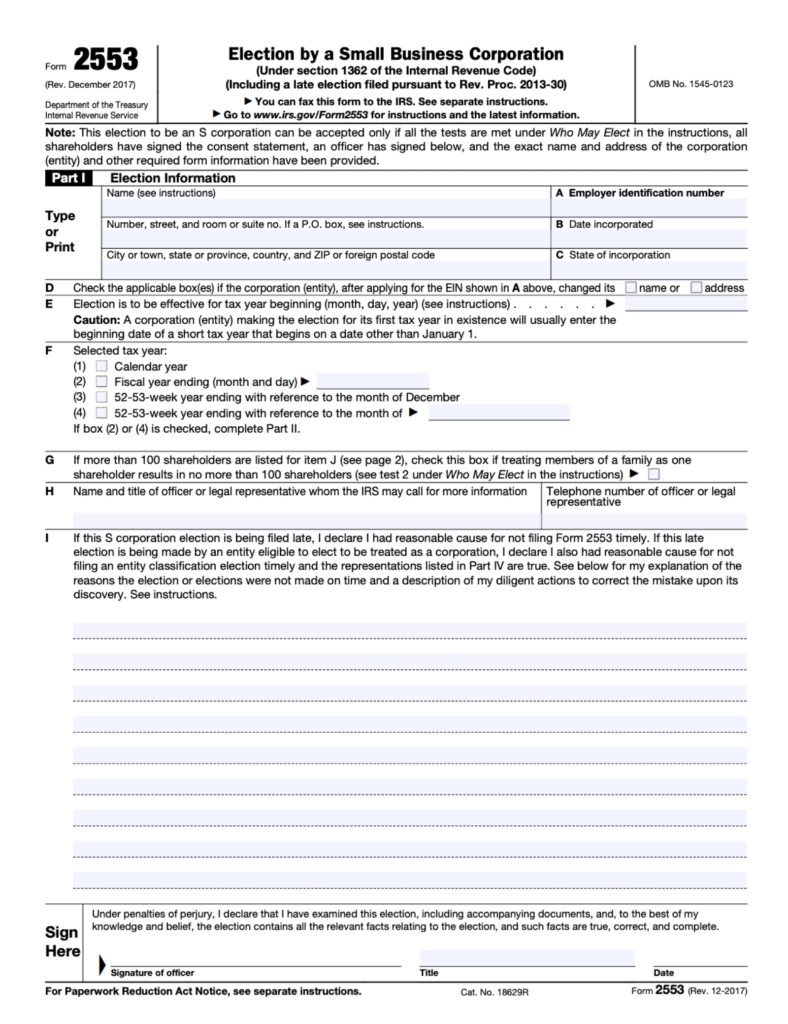

Part 1: Election Information

Part one of Form 2553 is kind of like writing your name at the top of an exam. For this part of the form, you need:

- Your company’s legal name. You can find this in your company creation documentation.

- The address for your company. If the mailing address belongs to an individual, include “℅” and the individual’s name after your company’s legal name.

- Your employer identification number (EIN).

- The date your company was incorporated. Again, refer to your company creation documents.

- The state where your company was incorporated.

- The tax year for your S-corp election to start. This is important: Form 2553 must be filed within two months and 15 days after the start of your tax year. Yes, you can make a late election, but you have to have a reasonable explanation and meet the requirements for late filing.

- Your tax year. In most cases, this will be the calendar year, and your Form 2553 must be filed by March 15. You can choose a different fiscal year if it makes business sense to do so, but there will be a fee assessed for doing this.

- Name and title of the corporate officer or legal representative the IRS can contact about your Form 2553.

- Information for each shareholder, and each shareholder’s signature. This is on page two of the form, and you can make additional copies if you have more than seven shareholders. Just remember you are limited to 100 shareholders for an S-corp election.

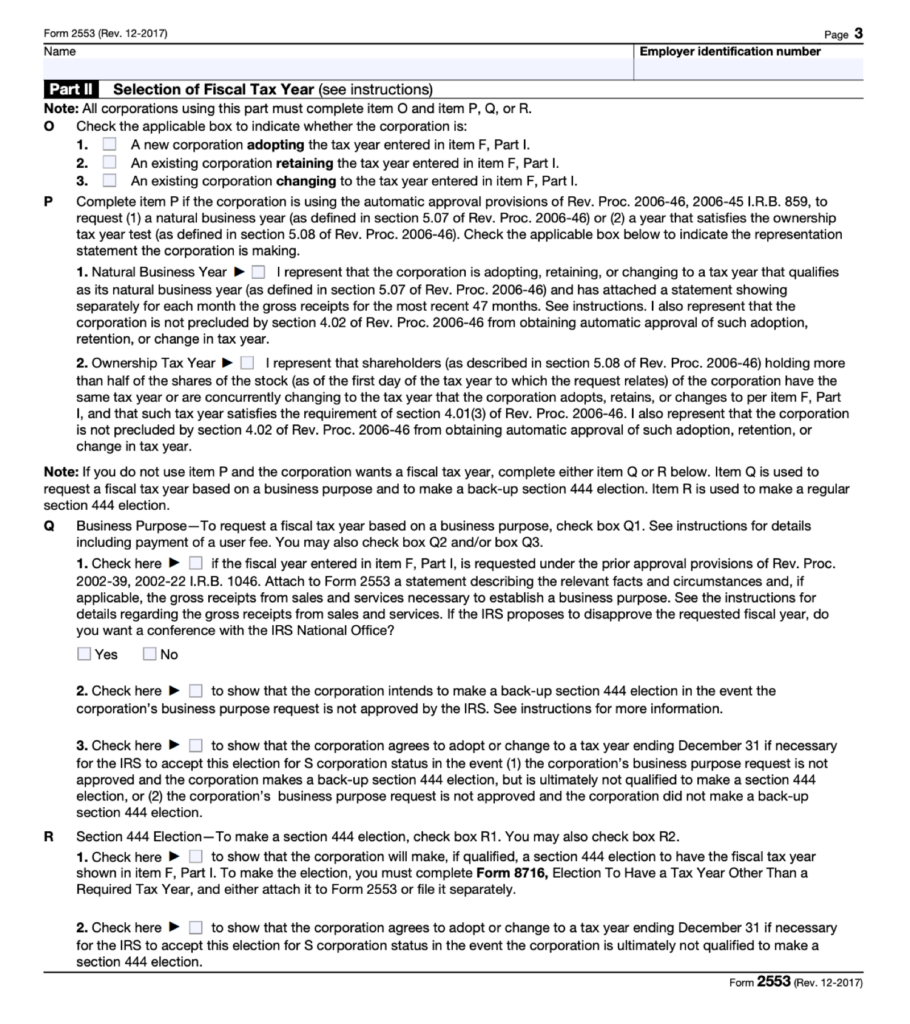

Part 2: Selection of Fiscal Tax Year

You will only complete this section of Form 2553 if you selected a fiscal tax year (meaning a year different than a calendar year) or a 52-week or 53-week tax year that ends in a month other than December. If you request a fiscal tax year based on a business purpose, a user fee of $6,200 will be assessed upon acceptance of your application.

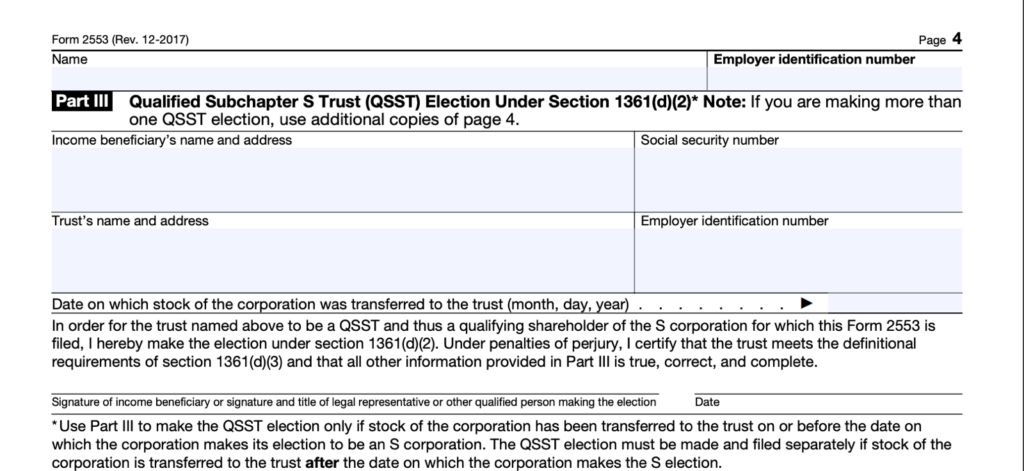

Part 3: Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)

As with Part 2, chances are you won’t need to complete this part of Form 2553. It only applies to trusts seeking S-corp status. If you are filing Form 2553 on behalf of a trust, you’ll provide the trust beneficiary’s name, address, and Social Security number, as well as the trust’s name, address, and Employee Identification number.

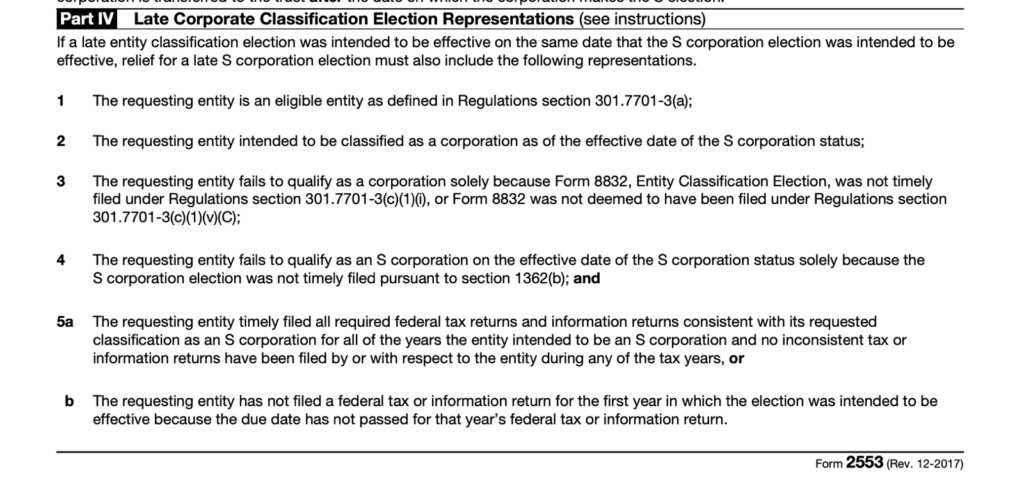

Part 4: Late Corporate Classification Election Representations

If you are filing after the IRS deadline of two months and 15 days after the start of your tax year, you will need to read this section carefully. By signing Form 2553, you are agreeing that all the representations in Part 4 apply to your situation. Signing without meeting the requirements could result in denial of your late election.

If, after reading this, you decide you can complete Form 2553 without your tax professional’s assistance, we recommend downloading and following the Instructions for Form 2553 as you complete the form.

Filing Form 2553

Once you have completed, reviewed, and signed Form 2553, it’s time to file it with the IRS.

There are four common pitfalls to avoid when filing Form 2553:

- Submitting incomplete forms. Make sure every field that applies to your business has been properly completed and that all shareholders are listed and have signed the form.

- Filing late. Although there is relief for filing Form 2553 late, you have to meet several requirements. It’s best to make sure your Form 2553 is filed by the deadline.

- Sending to the wrong location. Two IRS Centers accept Form 2553, and you must choose the correct one based on your company’s location. You can find the addresses and fax numbers, as well as determine which IRS Center you will submit your Form 2553 to, at this link.

- Not getting confirmation of delivery. Form 2553 must be mailed or faxed; there is no option to file this form online. If you choose to fax Form 2553, do so as soon as possible after the start of your election year. This will give you a little bit of time to follow up on your application if you don’t receive your determination letter from the IRS within 60 days. If you choose to mail Form 2553, request delivery confirmation and a signed receipt.

We’ve covered a lot of ground, but we need to discuss one last piece of business – getting your form submitted to the IRS.

The finish line: Deadline to file Form 2553

Form 2553 must be filed within two months and fifteen days of the start of the tax year in which it is to take effect. For calendar year filers, that is usually March 15. If March 15 falls on a weekend, then Form 2553 is due the next business day. And if it’s a leap year, the form is due on March 14.

You may also file Form 2553 at any time during the tax year before the year your S-corp election is to take effect. So, if your tax advisor suggests electing S-corp status for 2025, you could file Form 2553 at any point during 2024.

For those keeping score, if you file Form 2553 after the deadline, your S-corp election status generally takes effect the following year, unless you meet the requirements to make a late election.

What happens after filing Form 2553?

After you file Form 2553, keep an eye on your mailbox because the IRS will send you a determination letter approving or denying your application. You should receive this letter within 60 days of submitting Form 2553, so a little patience goes a long way. If you do not receive a letter within this timeframe, you can call the IRS for a status update at 1-800-829-4933.

If your application for S-corp status is approved, you must keep a copy of the letter and your completed Form 2553; you will need it when tax time comes around.

And speaking of filing your taxes: If you have previously filed as a sole proprietor, be aware that your Form 1120-S – your S-corp tax return – will be due on March 15 each year as opposed to April 15.

Get the facts before filing Form 2553

Even though most businesses’ ears perk up when tax savings are mentioned, submitting Form 2553 and electing S-corp status can be a complex process. While there are benefits to submitting this form to the IRS, seeking the assistance of a professional tax advisor can make good business sense (and help you put your best foot forward when filing it). This can help ensure that it is completed correctly, meets all deadlines, and frees up time for you to focus on other tasks that move the needle.

Take a tour to see how easy payroll can be.