More from our experts

When an employer provides health coverage to its staff, Form 1095-C must be issued to employees and filed with the Internal Revenue Service (IRS). This is a requirement by law for both employers who provide health insurance, and those who choose to include it in their company’s benefits package. For example, under the Affordable Care Act (ACA), employers with at least 50 full-time employees — also referred to as Applicable Large Employers (ALEs) — are required to offer health insurance, or pay a penalty if they fail to provide coverage.

Fast facts about Form 1095-C

- Applicable Large Employers use IRS Form 1095-C to report specific information regarding health insurance coverage

- ALEs must provide the form to each full-time employee, regardless of whether health insurance was offered to the employee

- Failure to file, or provide Form 1095-C may result in IRS penalties

Though ALEs avoid penalties by providing health coverage to their employees, many also offer it because it can make companies more appealing to job seekers. That said, either scenario has specific reporting obligations, including the issuance and filing of Form 1095-C.

In this guide, we’ll discuss more about the purpose of Form 1095-C, who should receive it, the required criteria to make sure it is filed without issues, and what can come of failing to distribute or file the form.

What is Form 1095-C used for?

To begin, Form 1095-C, or “Employer-Provided Health Insurance Offer and Coverage,” was developed by the IRS for ALEs to satisfy applicable reporting requirements under the ACA.

In addition, the form is used to:

- Provide employers with 50 or more full-time employees (including full-time equivalents) with a way to report information mandated by sections 6055 and 6056 of the ACA (both of the links will direct you to the exact spots in the law that mention these mandates). As mentioned earlier, these employers are referred to as “Applicable Large Employers,” or ALEs

- Give ALEs a way to submit information to the IRS regarding the health insurance they offer or do not offer to their employees

- Help ALEs provide information about the available coverage to employees eligible for group health insurance

- Assist the IRS in determining whether an ALE should pay a penalty under the ACA’s employer-shared responsibility provisions. An ALE may owe this payment if it fails to offer affordable and minimum essential coverage to at least 95% of its full-time employees. Penalties may also be incurred for failing to adhere to applicable reporting requirements

- To help the IRS determine whether an employee qualified for the premium tax credit because the coverage their employer offered was not affordable, or did not meet the minimum essential value

Among other things, Form 1095-C shows the months in the previous calendar year that the employee was eligible for coverage plus the cost of the coverage offered to them.

Now that we better understand what Form 1095-C is used for, let’s talk about which employees are supposed to receive it.

Download Form 1095-C – Employer-Provided Health Insurance Offer and Coverage – PDF download

Issue this form to employees and file with the Internal Revenue Service (IRS) as an employer with 50 or more full-time employees.

Who receives a Form 1095-C and what should they do with it?

In a nutshell, every individual who was employed as a full-time (or full-time equivalent) employee by an ALE for any month of the calendar year must receive a Form 1095-C.

This rule applies to both:

- Employees who enrolled in the company’s health insurance plan

- Those employees who declined coverage, or were not offered any coverage

Did you know?

It’s important to note that for ACA purposes, employees who work an average of 30 hours or more per week are considered full-time.

In addition, part-time employees must receive Form 1095-C if they were enrolled in the plan, and their employer is a self-insured ALE. Those employees who did not enroll in their employer’s self-insured plan are not entitled to receive the form.

Employers have several options for getting this paperwork into the hands of their employees, as Form 1095-C can be mailed, hand-delivered, or sent electronically, provided that the employee consents to electronic delivery.

What should staffers do once they receive their 1095-C?

It can be a good idea for employees to retain Form 1095-C for their personal records. Although they don’t have to attach the form to their tax return, they can refer to the information in it when completing the return.

If an employee opted out of their employer’s coverage and instead bought health insurance on their own through the healthcare.gov marketplace, Form 1095-C will show how affordable their employer’s coverage was and whether they were eligible for the premium tax credit.

Now that we’ve covered the employee side of Form 1095-C, let’s look at the employer’s responsibilities.

Should all employers file Form 1095-C?

Only Applicable Large Employers must file Form 1095-C with the IRS. (Employers with fewer than 50 employees are off the hook when it comes to filing it.) That said, ALEs must file the form, regardless of whether or not they offered employee health insurance coverage.

What are the steps to fill out Form 1095-C?

Completing Form 1095-C should not be too time consuming, as you will see below. The form is divided into three parts:

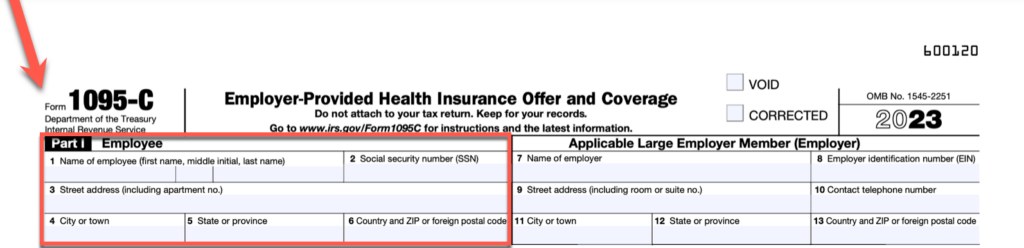

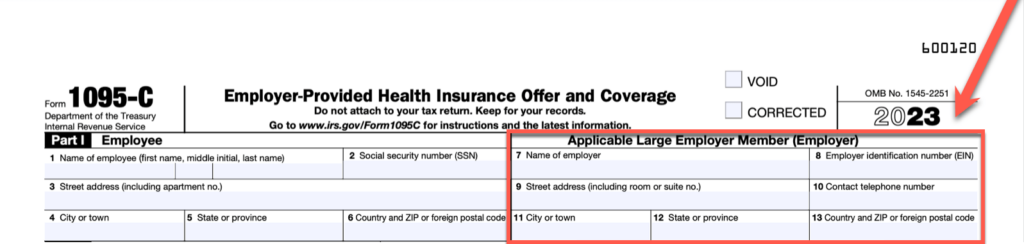

Instructions for Part I:

- Lines 1 – 6: Enter the employee’s information, including their name, Social Security Number (SSN), and address.

- Lines 7 – 13: Enter the Applicable Large Employer’s information, including its name, Employer Identification Number (EIN), address, and phone number.

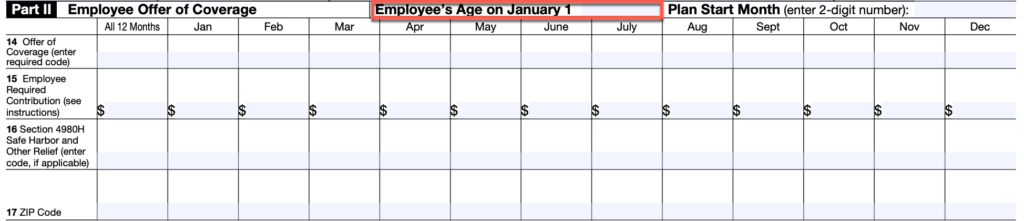

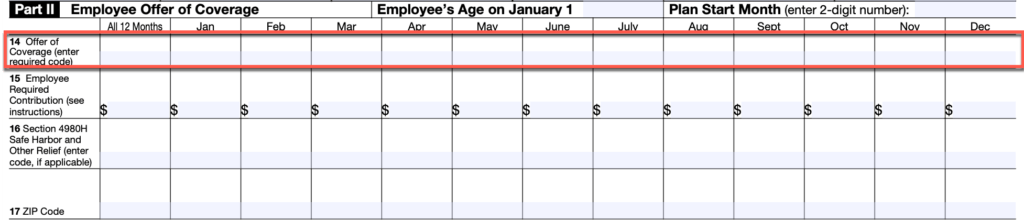

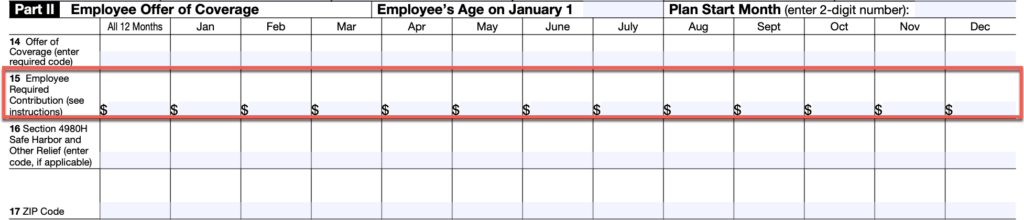

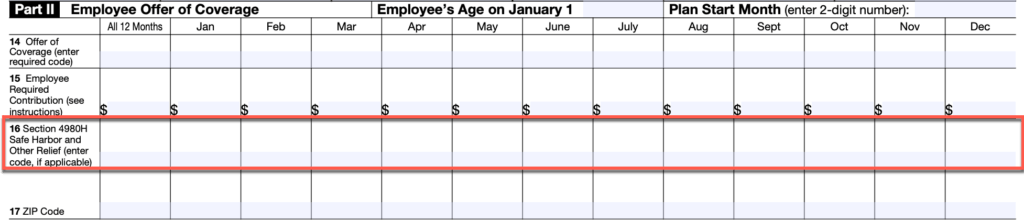

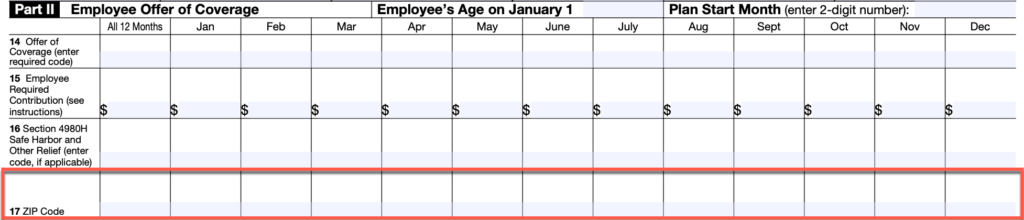

Instructions for Part II:

- Enter the employee’s age as of January 1, 2023, if you offered them an individual coverage HRA, or Individual Coverage Health Reimbursement Agreement (ICHRA).

- Enter the two-digit number (01 – 12) representing the calendar month in which the health insurance plan year starts. If you did not offer the employee coverage, enter “00.”

- Line 14: Enter the “Offer of Coverage” information using the required code. The IRS provides a series of codes in its instructions, indicating whether coverage was offered, the type of coverage, and the month(s) in which coverage was offered.

- Line 15: Enter the employee’s required contribution, that is, their monthly premium amount.

- Line 16: Enter the applicable code if any of the safe harbors or relief measures outlined in the IRS’ instructions were applied to the employee.

- Line 17: Enter the zip code where the employee resides if you offered them an ICHRA. The IRS uses this information to determine the ICHRA’s affordability.

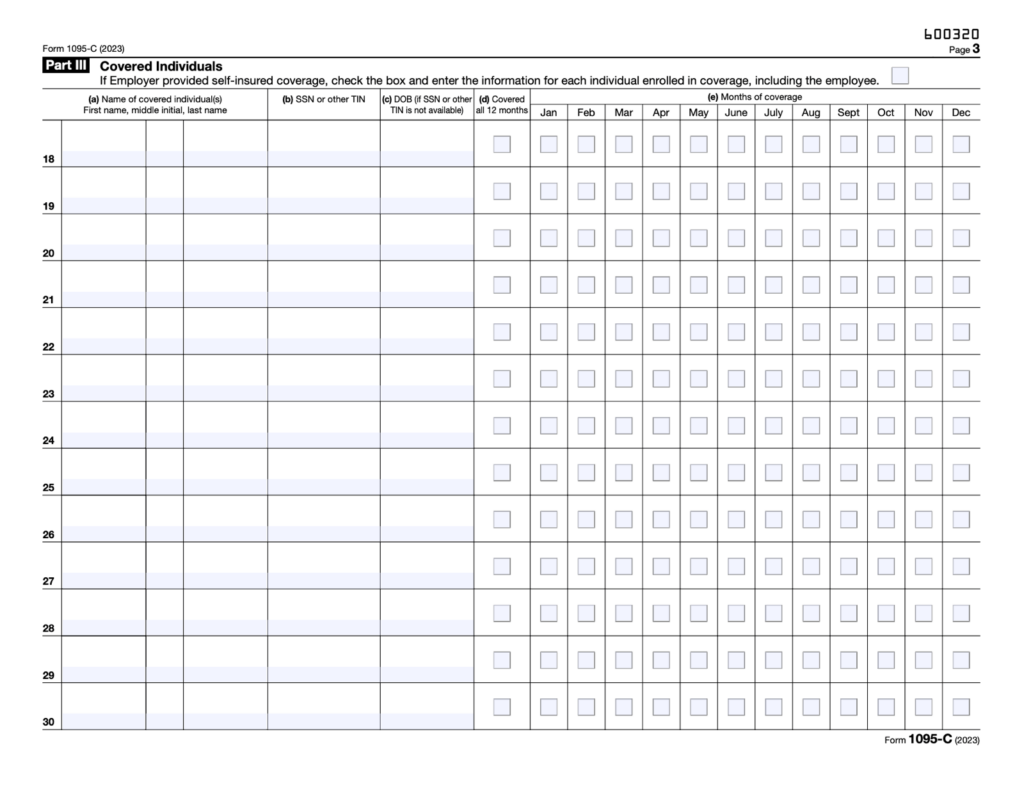

Complete Part III of Form 1095-C only if you provided self-insured health coverage, including an ICHRA. In this section, enter the required information (name, SSN, etc.) and month(s) covered for each employee and dependent who were enrolled in the plan.

What is the deadline to furnish and file 1095-C forms?

For the 2023 calendar year, ALEs were supposed to furnish 1095-C forms to employees by March 1, 2024. Note that the IRS automatically extended the due date from January 31, 2024, to March 1, 2024, and has stated that “no additional extensions will be granted.”

That said, ALEs are generally required to report Form 1095-C to the IRS by February 28 if filing by paper, and by March 31 if filing electronically. Therefore, for the year 2023, paper filings were to be submitted by February 28, 2024, and electronic filings by April 1, 2024. Keep in mind, ALEs must also file Form 1094-C, the transmittal form, along with their Form 1095-C submission.

Note that ALEs are required to file electronically if they have 10 or more Form 1095-Cs. These returns can be submitted electronically through the AIR (Affordable Care Act Information Returns) system. In addition to this deadline information, you may find another resource we have with payroll tax dues dates helpful.

Though it’s not our favorite topic to discuss, let’s touch on potential fines an ALE may have to address should Form 1095-C fall by the wayside.

Penalties for failing to furnish or file Form 1095-C

So, what happens if an ALE fails to get this document into the hands of Uncle Sam and the employees who should receive it? ALEs who fail to file, or provide the form, may face the following IRS penalties:

- $310 for each Form 1095-C the employer does not correctly file, with a maximum penalty of $3,783,000 per year

- $310 for each Form 1095-C the employer does not correctly furnish to employees, also with a maximum penalty of $3,783,000 per year

If the employer intentionally disregarded the filing requirements, the IRS may increase these penalties. However, if there is a reasonable cause for noncompliance, the IRS may waive the fines.

To avoid failure-to-file penalties, ALEs may request a 30-day extension by submitting IRS Form 8809. It is essential to file this form by the due date.

Resources mentioned in the article around Form 1095-C

For your reference, the resources below are linked in the article text above.

Get familiar with Form 1095-C

Offering employees access to health benefits can attract talented job seekers to your company and discourage long-standing employees from moving to another organization. It can also help with compliance, as certain employers are required by law to provide health insurance based on the size of their workforce. It can be worthwhile for businesses who offer this perk to find out more about Form 1095-C so that the IRS — and employees who need to receive the plan details — receive it without issues.

Take a tour to see how easy payroll can be.