More from our experts

According to JP Morgan Chase & Co., the net worth of self-employed individuals is over four times as much as their peers in the workforce. That adds up to over 15 million people who enjoy being their own boss and the freedom that comes with it. And for many who take the plunge into the brave new world of business ownership, getting to chart their company’s course — and contribute to the economy — is both a rewarding and profitable experience. But joining the ranks of those who work for themselves also requires a new responsibility: making estimated tax payments.

As a self-employed individual, you don’t have an employer withholding taxes during the payroll process to pay for your share of programs such as Medicare and Social Security. Instead, that task falls on your shoulders, so understanding what estimated payments (also called quarterly payments) are and paying them according to Uncle Sam’s schedule can help you avoid an unwelcome lump sum payment required at tax time.

Let’s find out more about estimated tax payments, calculating them, and how to pay them to avoid penalties.

What is an estimated tax payment?

In the simplest terms, an estimated tax payment is the amount of taxes you estimate you will owe for the upcoming tax year. While you can pay the total amount of taxes you owe all at once, many self-employed business owners opt to estimate what they’ll owe and divide it into four equal quarterly payments that can be made throughout the year.

Ultimately, the ball is in your court: if you want to pay the taxman all at once, instead of per quarter, you have the option. But you need to make payments according to the IRS schedule (which we’ll cover further in the article.) Picking a random date on the calendar to complete a payment is not an option.

Estimated tax payments: who pays them?

If you’re a self-employed individual, a sole proprietor, a partner, or an S corporation shareholder, and you expect to owe taxes of $1,000 or more, you’ll have to make estimated tax payments. In a nutshell, these payments cover the tax amount you’re required to pay on earnings that are not subject to withholding. The requirement to make estimated tax payments applies to US citizens, including residents of Puerto Rico, Guam, American Samoa, the US Virgin Islands, and the Commonwealth of the Northern Mariana Islands.

The good news is the IRS provides resources to make it a fairly straightforward process.

How do you calculate estimated tax payments?

Most people find it easy to use Form 1040-ES (also known as Estimated Tax for Individuals) to estimate yearly income and calculate their quarterly payments at that time. The form includes an Estimated Tax Worksheet on page eight that asks you to enter estimated gross income, any deductions and credits you expect to take on your tax return, and any other taxes that may be due. Here’s what the worksheet looks like:

Conveniently, a Self-Employment Tax Worksheet is also included on page six, so you’re able to calculate the amount of self-employment tax owed, since it needs to be included in your estimated tax payments.

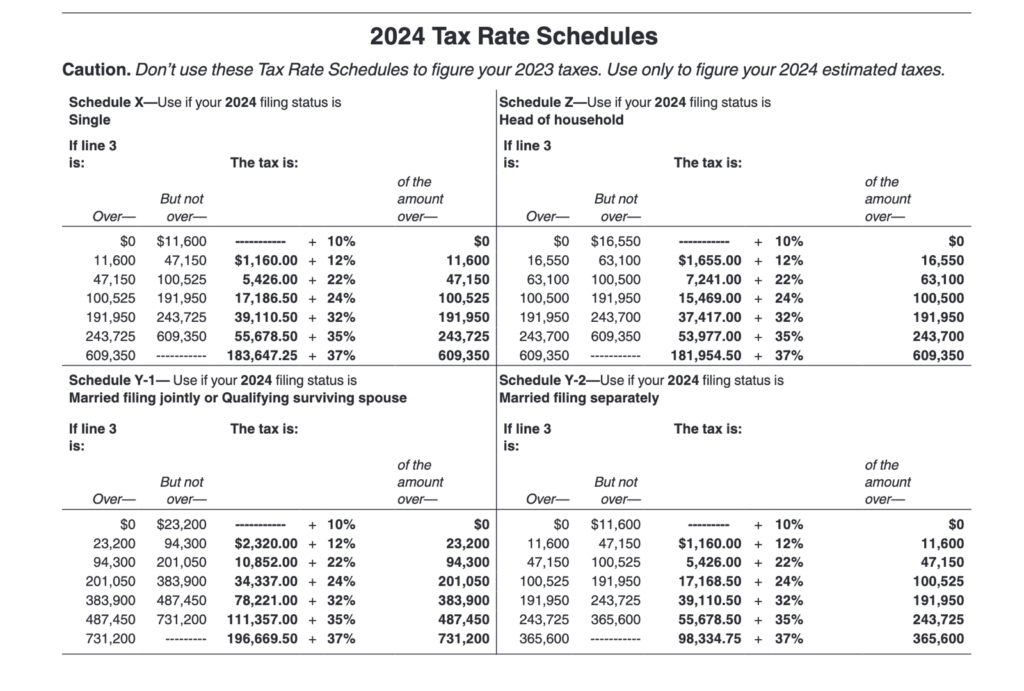

Also included in Form 1040-ES is a Tax Rate Schedule, on page seven, which allows you to calculate your estimated taxes owed using the rate table.

If you’re not sure of your obligations, you should reach out to your bookkeeper or a licensed tax professional to crunch the numbers — so you know how much you owe.

How do you pay estimated taxes online with Form 1040-ES?

Though Form 1040-ES includes payment vouchers for estimated tax payments, the vouchers are only used when paying taxes with a check or money order. You can still use the form to estimate taxes, but if you typically pay your taxes online, you can pay any estimated taxes due using your online account.

Other options for paying your taxes include IRS Direct Pay, payment by phone, or by using EFTPS. There is also an option to pay by credit card, though a convenience fee is added to any taxes you may owe. The IRS even provides the option to pay estimated taxes on your mobile device through their IRS2go mobile app.

Are you able to pay estimated taxes without Form 1040-ES?

Form 1040-ES is only needed for those that pay estimated taxes with a check or money order by mail and is not required to make an estimated tax payment online.

When are estimated tax payments due in 2024?

Payment due dates change with each tax year, but generally, the dates you can count on from the IRS (which you may want to highlight on your calendar) are the 15th of April, 17th of June, 16th of September, and 15th of January, 2025.

For 2024, payment due dates, according to the IRS calendar are as follows:

| Estimated tax payment due date: | Income earned during the period of: |

| Monday, April 15, 2024 | January 1 — March 31 |

| Wednesday, June 17, 2024 | April 1 — May 31 |

| Thursday, September 16, 2024 | June 1 — August 31 |

| January 15 of 2025 | September 1 — December 31 |

For example, in 2024 the first date quarterly taxes are due is April 15th, or whatever day the IRS has designated as the tax filing deadline for the year. Remember, what’s listed above is a schedule. You can choose to pay all your estimated taxes — due on any date on the schedule — or split the taxes into four equal amounts.

What are the penalties when you miss a quarterly estimated tax payment?

The IRS may apply a penalty when you file your return if you end up owing additional tax — and it can even happen after estimated taxes have been paid. A penalty may also be imposed if your payment is late. For example, if you determined that your estimated taxes for the year are $4,000 and you want to pay in equal installments, any installment received after the due date may be assessed a penalty, even if you end up with an overpayment for the year. According to the IRS, penalties can vary but tend to be at least a couple of hundred dollars when you incur one.

One last note: If you cannot meet your tax obligation — or need options — you can apply for a payment plan through the IRS.

Bottom line: It pays to understand estimated tax payments

While it can sometimes be a cumbersome part of being self-employed, it’s a good idea to understand the ins and outs of paying estimated taxes. Once your ducks are in a row, making sense of when payments are due — and processing them on time — creates one less task so you can keep the focus on scaling your business.

Please note all material in this article is for educational purposes only and does not constitute tax or legal advice. You should always contact a qualified tax, legal or financial professional, in your area for comprehensive tax or legal advice.

Take a tour to see how easy payroll can be.